SAP S/4HANA Cash Operations – An Overview

Introduction

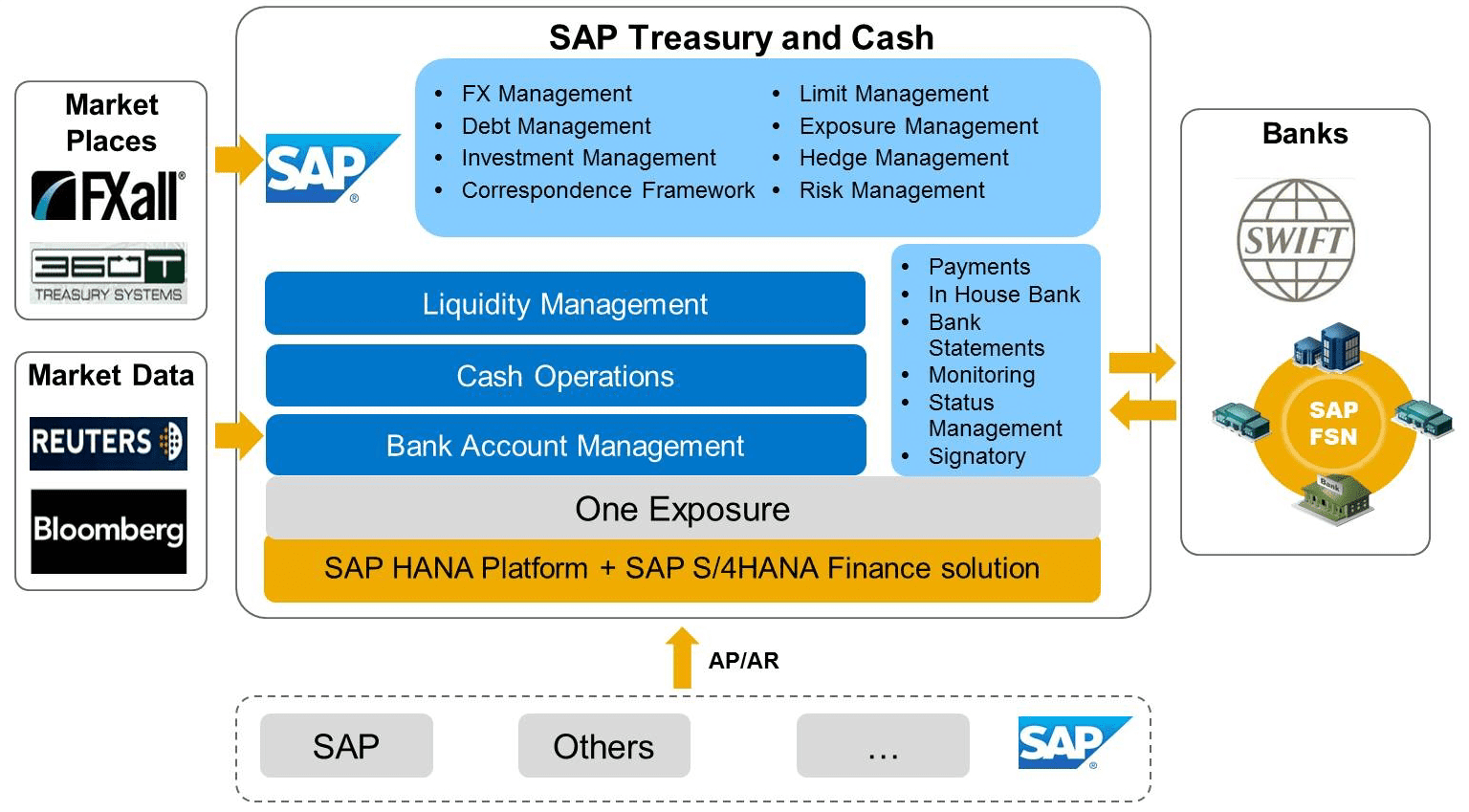

Cash Management is a key function in every organization for it to function efficiently. In a broader sense, maintaining appropriate bank accounts, collecting the receivables in time and planning & release of cash for payables in a timely manner, are all part of the Cash Management function. In many unoptimized organizations, tools such as spreadsheets are extensively used to perform Cash Management Functions. SAP has built an Integrated Treasury and Cash Management solution on the S/4HANA Platform. Refer the exhibit-1 below for a broad overview.

Exhibit -1 (Credit : SAP SE)

In S/4HANA, SAP Cash Management is a separately licensed solution. Customers may obtain more information regarding licenses from appropriate SAP Customer Engagement Teams. SAP Cash Management consists of three components, namely “Bank Account Management” (BAM), “Cash Operations” and “Liquidity Management”. BAM handles the Bank Master data creation, approval, payments and Bank statement upload/download operations. Cash Operations consists of day to day management of cash inflow/outflows, overseeing “Bank Risks” and approving and monitoring payments. This is typically management of cash availability now and the following few weeks. “Liquidity Management”, on the other hand, is complete management of funds for the medium term until the end of year onwards.

In this Blog, let us focus on the “Cash Operations” component. We will broadly divide this topic into two parts. The first part will provide information on the “functions available” for a typical Cash Manager. The second part will provide information on the important customizations necessary in Cash Operations.

Functions in Cash Operations:

The role of a typical Cash Manager consists of the following tasks:

• Monitor and ensure all the bank statements have been imported successfully to SAP

• Check the cash position details, analyse and ensure they are in order

• Based on forecasts, perform bank transfers between different banks to balance “Bank Risk”

• Approve payment approval requests for bank transfers and outgoing payments (by Designated Senior Cash Managers for example)

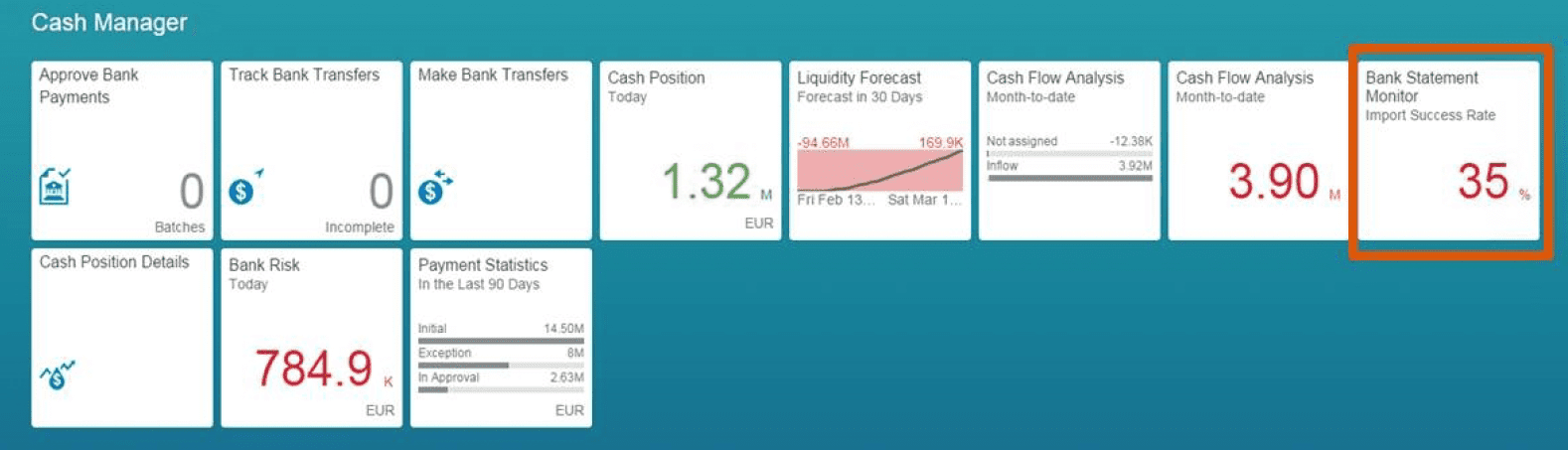

There are different Fiori Apps for performing each of these functions. Refer the Exhibit-2 below, which shows the screenshot of Cash Manager role-related standard Fiori apps.

Exhibit -2 (Credit: SAP SE)

Bank Statement Monitor App:

The Fiori ID of this app is F0514. This app provides overall status of the imports of bank statements for all the banks. The error in imports, shown in the monitor, should be followed up with whoever is responsible (for imports) and resolved. The app has features to send mails to the responsible person, based on customizing settings already put in place. There are multiple views provided, such as “By Country / By Company/ By Bank / By Bank and Company / By Bank Account” – the Cash Manager will be able to monitor and zoom-in to specific details of transactions.

Cash Position Details App:

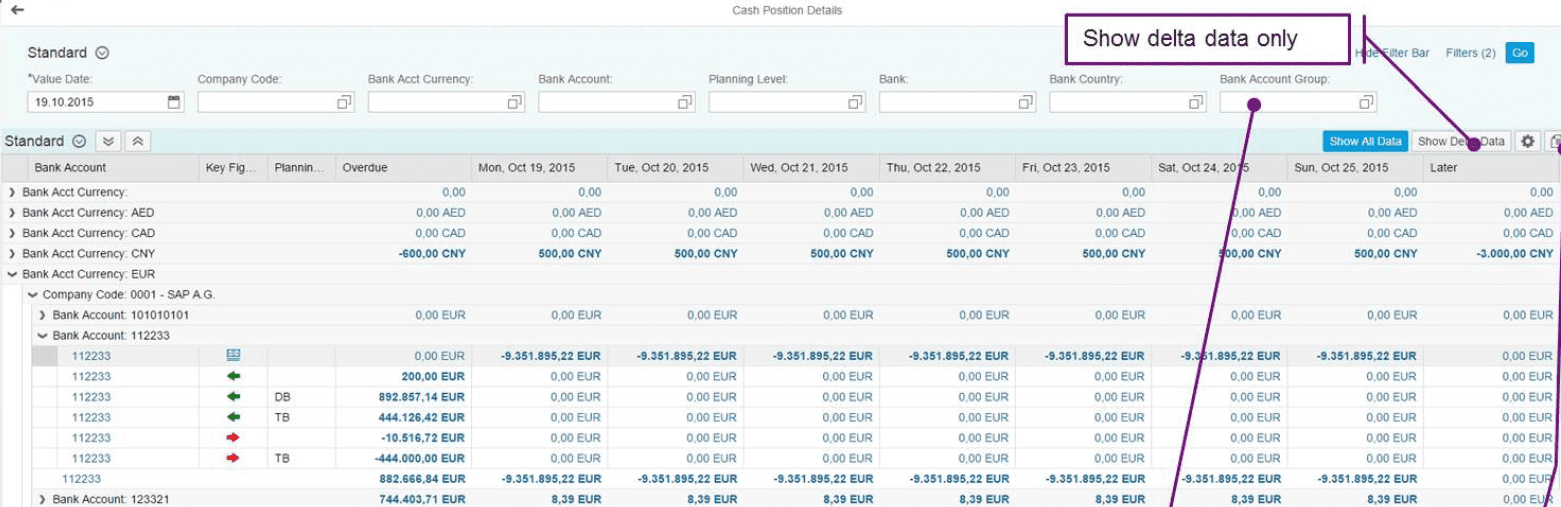

There is a Cash Position summary app (Fiori ID: F1737), which shows cash amounts at a summary level in different views. Examples of the views are “By Company, By Currency” and such other views as mentioned above. There is also a cash position details app (Fiori ID: F0737), which shows details hierarchically. There is a default group hierarchy, defined in customizing, which is Bank Account Currency > Company Code > Bank Account. The days due are shown as Overdue (60 days before value date), Following 7 days from value date, Later (8 days and beyond from value date). This is shown in the sample screen shot in Exhibit-3 below. There are hyperlinks available in the report at different data points such as Bank Account and Amount. The Cash Manager can click on them find further details if needs be.

Cash Flow Items App:

This is a Cash Flow Items app (Fiori ID: F0735), which provides details of all transactions, from the cash flow. Since it is a Fiori app, there are hyperlinks available at different data points such as document number, amounts etc… The Cash Manager can look at the original transaction documents, for example MM, SD, AP, AR, PO, Journal entries etc. This can help them reach the error documents or exceptional transactions.

Exhibit -3 (Credit : SAP SE)

Make Bank Transfer and Track Bank Transfer Apps:

The Cash Manager, using the Make Bank Transfer app (Fiori ID : F0691), can perform bank transfer of funds to align to the allocations planned for different bank accounts. The Cash Manager only needs to select the source and target the bank accounts, amounts to transfer, payment method and choose the “Make Bank Transfers” option. The Track Bank Transfer (Fiori ID: F0692) app shows the transaction details of all bank transfers. The different status’ such as “in approval, approved, sent to bank, completed” are also clearly shown for each transfer. Again, the Cash Manager, in terms of each of the transfers, can get more details if needed.

Payment Statistics App:

Using this app (Fiori ID: F0693), the Cash Manager has an overview of the payments made. They can analyse payment statistics, using different criterion such as company, status, bank, etc… They can look in detail at the displayed data using hyperlinks provided on appropriate data points.

Customization Settings for Cash Operations

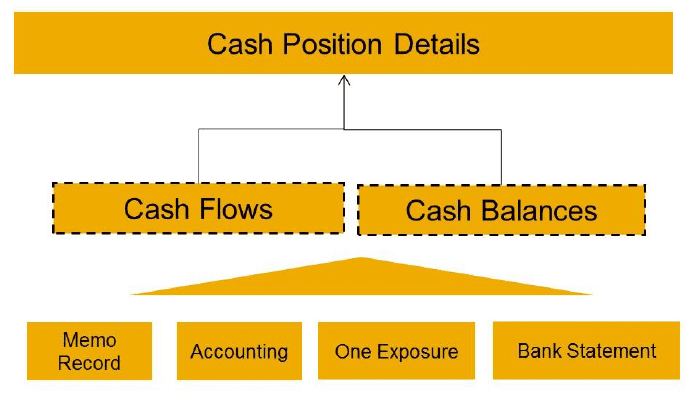

In Cash Management, the data is aggregated based on the individual transactions occurring in different segments such as FI, SD, MM etc… It is explained in a simple diagram shown in Exhibit-4 below. Since data from multiple sources has to be aggregated, the concept of One Exposure is utilized. One Exposure from the Operations Hub is a real-time storage point and collection location for operational data for Cash Management Solutions.

Exhibit -4 (Credit : SAP SE)

There are three new concepts used in Cash Management to achieve such aggregation of data. They are as follows:

1. Flow type: Cash flow starts as forecast numbers first and then the actual cash flows happen. Flow types make this distinction and helps differentiate the forecast and actuals in Cash Operations and consequential statements.

2. Liquidity Item: Liquidity Item indicates the business purpose of the cash flows. Typically, Liquidity Item hierarchies are configured and used in cash management reports.

3. Planning Level and Planning Group: These are used as integration data with other components such as Customer data and Vendor data.

Flow Types – Configuration

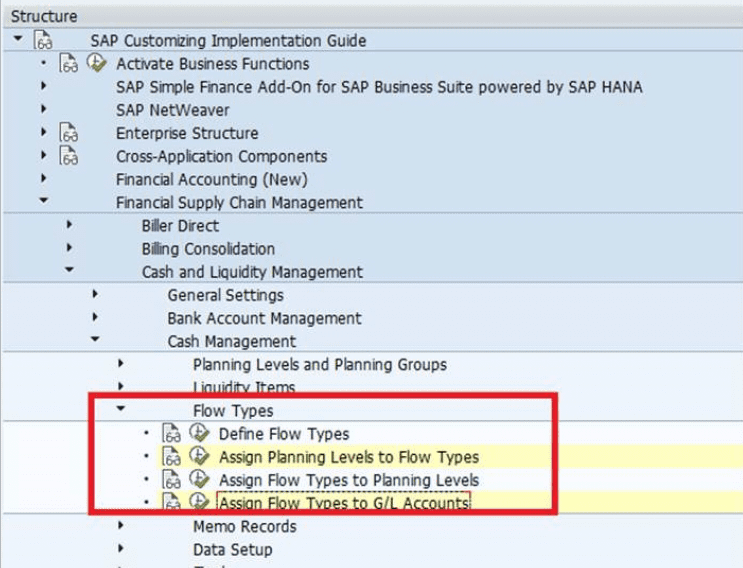

SAP has delivered, a pre-configured standard set of flow types, to start with. Customers can enhance it with additional types if needed. The following exhibit-5 shows the customizing node for Flow Types.

Exhibit -5 (Credit : SAP SE)

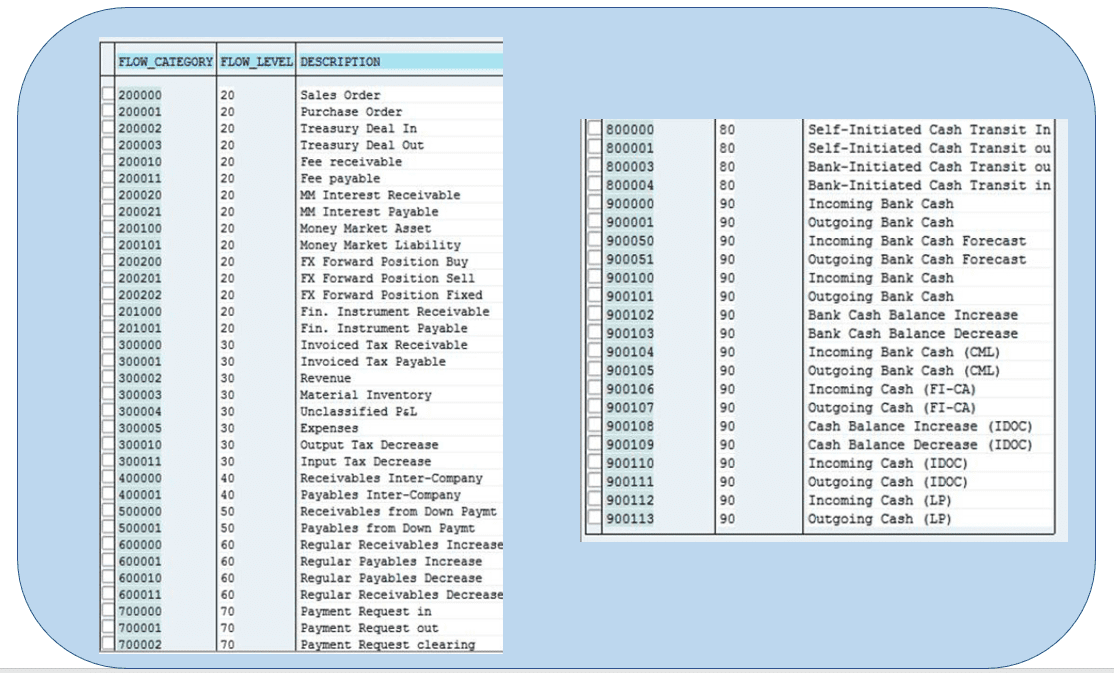

Every data record flowing into the Cash Management system must have a Flow type assigned. The data flows from either BSEG directly or from One Exposure. The Flow types are categorised as “forecast” or “actual”. Refer to exhibit-6 below, which shows a screen shot of SAP delivered flow types in the customizing section. Flow types starting from 20xxxxx to 80xxxxx are “forecasted cash flow items” and 90xxxxx are actual cash flow items, confirmed by Bank credit/debits.

Exhibit -6 (Credit : SAP SE)

These customizing settings are stored in table FQMI_FLOW_CAT.

Relevant General Ledger (GL) accounts, needs to be assigned to a flow type in customization as shown in the table below, to categorise them as “actual” or “forecast”.

| GL accounts | Classification and Explanation |

| Bank GL accounts | Actual. These entries confirm actual cash flow to Bank accounts |

| Clearing Bank GL accounts | Forecast. These entries mean either the payment is booked in SAP but they have not yet been sent to Bank or it has not yet been confirmed by Bank |

| Payment request Clearing GL accounts | Forecast. These entries mean they are ready for a payment run to make actual payments |

| Tax GL accounts | Forecast. These entries are forecasted cash flows in Liquidity forecast. |

SAP has “Pre-defined” a derivation logic to assign a flow type to BSEG records. This is shown below.

However, customers can extend or overwrite the pre-defined logic of GL accounts, which are applied only for BSEG records. This is done using the customizing node shown earlier (assign flow type to GL accounts). A sample of the customizing screen is shown in exhibit-7.

Exhibit – 7 (Credit : SAP SE)

Liquidity Items – Configuration

As mentioned earlier, Liquidity Item indicates the business purpose of the cash flow. For example, in cash management report one can categorize cash flows and show the following:

1. Cash flows from Operations

2. Cash flows from Investment activities

3. Cash flows from Financing activities, and so on…

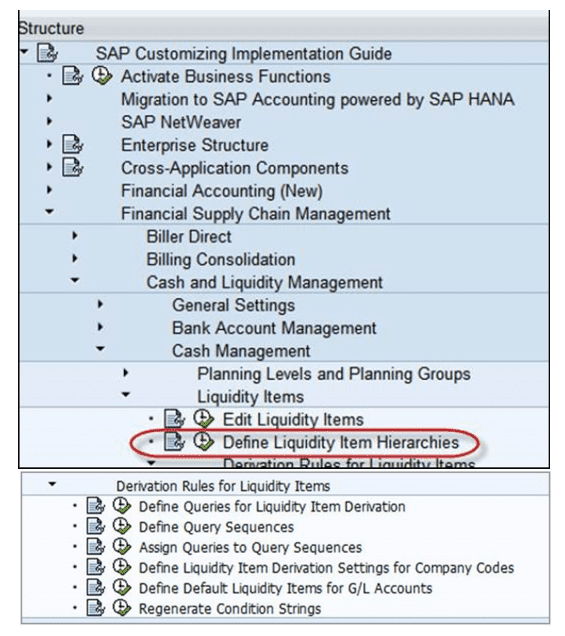

Liquidity items are typically structured in a Liquidity Item Hierarchy. It is also possible to “derive” the Liquidity Item based on custom built query and sequencing them appropriately. The sequence of steps would be as follows:

1. Create a query sequence for the new origin

2. Create queries to be linked to the query sequence

3. Assign the queries to the query sequence

4. Define the default liquidity item derivation parameters for a company code

The IMG config node, relevant to this, is shown in exhibit -8 below.

Exhibit -8 (Credit : SAP SE)

There is also a provision to assign, “default liquidity item assignment” for GL accounts. You can see the node relevant to this in the exhibit – 8 above. It should be noted that the derivation logic by query and query sequence has a higher priority than the default liquidity item assignment for GL accounts. A sample screen shot of the customizing screen for default liquidity item assignment is shown in exhibit-9 below.

Exhibit -9 (Credit: SAP SE)

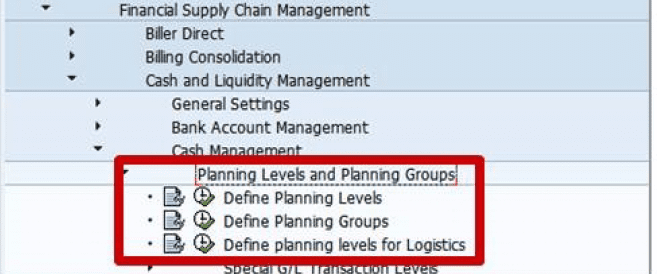

Planning Levels and Groups – Configuration

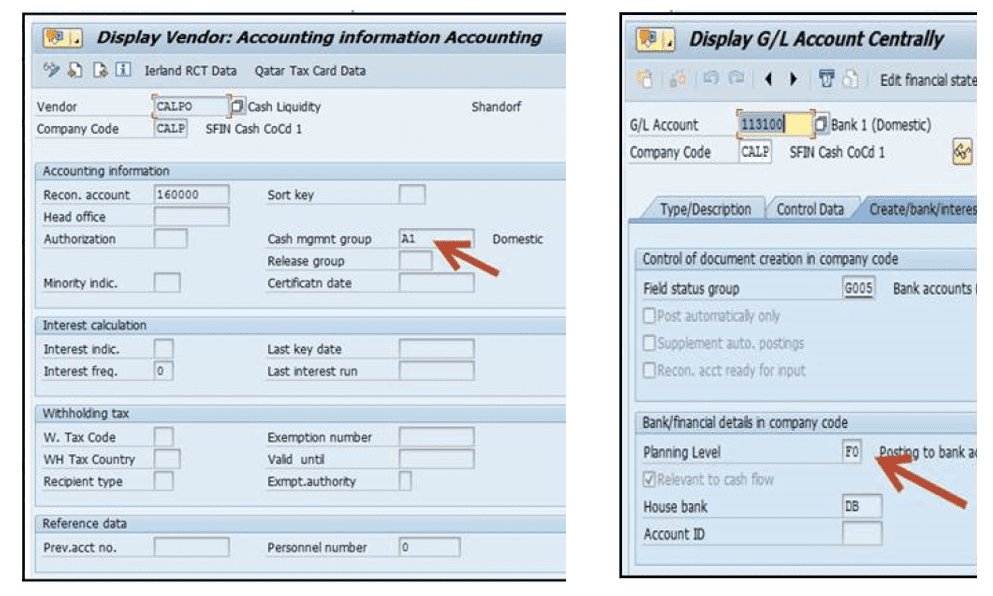

In order to ensure that other components work in tandem with Cash Management, it is mandatory to define and assign Planning Levels and Groups. Calculation of Planning Dates is an important component while aggregating data for cash management from different modules such as FI, AR, AP, etc… Based on these assignments, the Planning Date is calculated and stored in a specific field (FDTAG) in GL documents. You can also specify the Planning Level of the Bank Account Balance data uploaded through excel, in the IMG node Financial Supply Chain Management > Cash and Liquidity Management > Cash Management > Flow types > Assign Planning levels to Flow types. A screen shot of IMG node for customizing Planning Levels and planning data in GL and Vendor accounts is provided in exhibit-10 and exhibit-11 below.

Exhibit -10 (Credit: SAP SE)

Exhibit-11 (Credit: SAP SE)

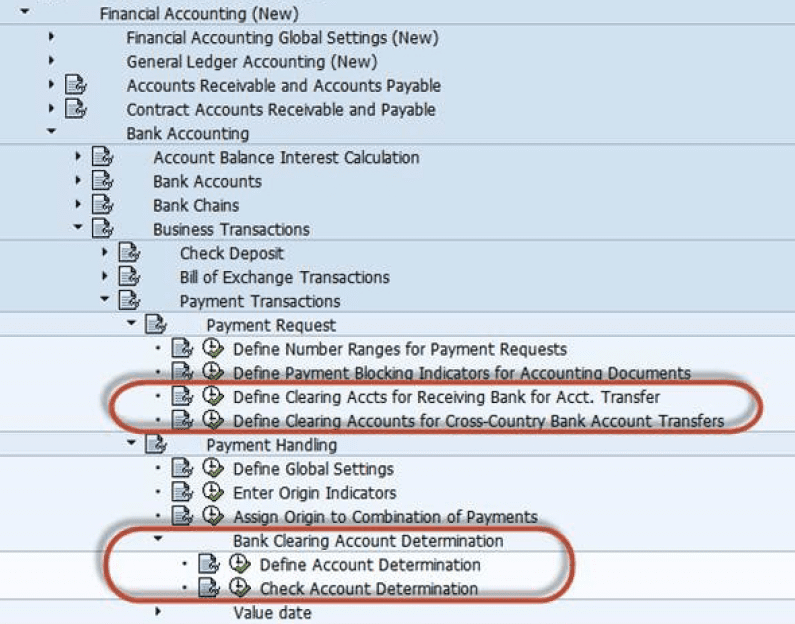

Bank Transfer Functionality – Configuration

The “Make Bank Transfer” functionality needs to create a “Payment Request” to process the Bank transfers. An appropriate configuration needs to be actioned. The IMG nodes relevant to this are shown in the exhibit-12 below.

Exhibit -12 (Credit: SAP SE)

Summary:

To summarise, Cash Operations is a simple, automated & streamlined functionality. However, it takes away a lot of manual work involved for the Cash Manager, in aggregating data from different sources, day-in and day-out. Despite its usefulness, I have rarely come across organizations implementing it as part of main SAP implementations. It can be configured/activated retrospectively as well. With a short course in SAP Education, the skill set can be easily acquired by Consultants. There are some new features added in the S/4HANA 1809 release. An SAP Blog by Ignacio Kristof explains them in brief, which is provided below in reference section.

References:

SAP Education module – S4F40

Configuration Guide for SAP Cash Management

Data Setup Guide for SAP Cash Management

Latest release 1809 – New Features for Cash Management and BAM

Author: Ravi Srinivasan, SAP Alumni