Overview of Digital Payments Using SAP S/4HANA

Abstract

The Most Important aspect in Receivables Management is Automation of Order to Cash Process. It might be using SAP On-Premise or SAP S/4HANA Cloud. Invoicing to Customers and handling incoming payments is one of the most important challenges in Financial Accounting. SAP S/4HANA Cloud for customers and SAP digital payment add-on are perfectly suited to match the high expectations for process automation and swiftness in daily operations. The automation improves the cash collection process and enhances productivity of Accounts Receivables departments. Using electronic bill presentment and payment tool SAP S/4HANA Cloud for customer payments, customers can register a Credit Card or PayPal payment method. Card Registration and approval or authorisation is done via the SAP digital payments add-on.

Introduction

Today, exponential growth in digitalisation is putting pressure on Finance Departments to digitalise the payment processes. Digitally enabled business models are forcing Finance Departments to become more agile and proactive. Finance Officers are being asked to drive strategy in a whole new way – providing instant insight and proactive advice on investments and on business model transformation. The Finance department needs to support the process of digital transformation across the enterprise. Finally, all these changes have the potential to impact Billing, Collection, Reporting, etc. Companies understand finance transformation will help to drive innovation and manage volatility. Real-time payments without the SAP digital payments add-on might be complex and costly. The SAP digital payments add-on is a payment hub between payment service providers and SAP components, solutions, or applications that process incoming credit card payments.

SAP digital payments add-on Credit Card Payments

SAP S/4HANA >>>> SAP Cloud Platform>>> Payment Service Provider

Several SAP S/4HANA consumer applications can be integrated with the SAP digital payments add-on. The consumer application sends a request to the SAP digital payments add-on. Based on the details of the request, the SAP digital payments add-on finds the relevant PSP routing. The request is then forwarded to the relevant PSP adapter where it is mapped into the appropriate format.

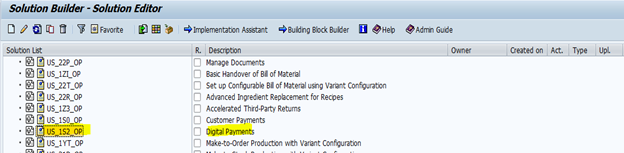

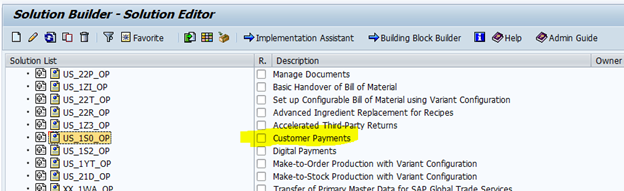

The scope item 1S2 – SAP Digital Payments add-on is available as a Best Practice item.

SAP Digital Payments add-on is machine-to-machine communication without a dedicated end user interface. In this regard you need to use the SAP digital payments add-on with a second scope item in combination to facilitate card payments for this process.

The scope item enables the integration between SAP S/4HANA (Cloud or on-premise) and SAP digital payments add-on, which allows for the use of credit card payment methods in SAP S/4HANA for incoming payments.

The complete process from settlement using secure tokens through to payment service provider advice to the final bank statement is covered and automated. Various payment service providers are supported.

Payment Card Processing:

Card Creation>> Card Authorisation>> Payment settlement >> Digital Payment Advice

External Payments

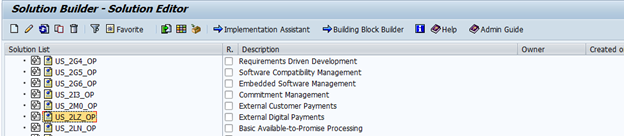

The SAP digital payments add-on also supports external payments. External payments are payments made using external channels. For example: online/mobile payment systems instead of payment cards. This part is provided by Best Practice Scope Item 2LZ. The External Digital Payments are especially geared towards payment solutions like PayPal.

Based on the PSP’s functional scope, external payments will be implemented using either a one-step procedure where the payment is charged directly to the payer’s account without any prior authorisation, or a two-step procedure (known as ‘charge with authorisation’) where the payment is first authorised at the payer’s account before debiting.

The system landscape for payment scenarios using the SAP digital payments add-on is composed of three elements:

1. Consumer application

2. SAP digital payments add-on on SAP Cloud Platform

3. Payment service provider

An overview on the process between the systems:

1. The consumer application sends a request to the SAP digital payments add-on.

2. Based on the details of the request, the SAP digital payments add-on finds the relevant PSP in a process called routing.

3. The request is then forwarded to the relevant PSP through its adapter where it is mapped into the appropriate format.

4. Connection to PSP is established.

Automation for Accounts Receivable

Receivables Management is a very important part of an order to cash process. SAP S/4HANA Cloud for customers payments is part of the Billing and E-Invoicing area. Therefore, it is an integral part of the Receivables Management.

Receivables management engines include:

• SAP Credit Management

• SAP Biller Direct

• SAP E-Invoicing for Compliance

• SAP Collections and Dispute Management

Customer Payments Architecture

SAP S/4HANA Cloud for customer payments enables you to match payments with invoices, manage payment advice, create and manage payments, view your account statement, manage the master data of your account and manage account assignments.

Card Process Overview

The below is on the basis of the SAP Cloud for customer payments in combination with SAP digital payments add-on.

• When a customer orders goods, the corresponding open item is posted towards his account.

• The customer is using the electronic bill presentment and payment functionality of the SAP Cloud Platform to assign credit card information to the open item.

• The SAP S/4HANA on-premise or SAP S/4HANA Cloud system receives this transaction information from the SAP Cloud for customer payments.

• Payment run will be executed in SAP S/4HANA on-premise or SAP S/4HANA Cloud system to collect Open item. Then, the customer open item is cleared and posted against the AR Credit Card Clearing Account.

• On initiation of the app Schedule Accounts Receivable jobs, It transfers funds from the AR Credit Card Clearing Account to the Cash Credit Card Clearing Account.

• Then, Bank Statement received clears the Credit Card Transfer account and posts the incoming funds on the main bank account.

Payment Card Process with SAP Cloud for customer payments

Post Customer item >>>Assign Credit Card >>> Payment Program>>>Settle Card Payment >>> Payment advise processing >> Bank Statement Processing

How to Configure SAP S/4HANA On-Premise Systems

Setting up SAP digital payments add-on.

There are three broad steps:

1. Prerequisites

2. Setup activities

3. PCI Compliances and Security

1. Prerequisites:

When implementing SAP digital payments add-on, below prerequisites are to be considered before starting the actual setup activities.

A. Transport Layer Security

B. User Account with Payment Service Provider

The SAP digital payments add-on can be used in combination with various consumer applications. Refer documentation of the relevant consumer application.to know relevant one. The SAP digital payments add-on connects the consumer applications to services provided by external PSPs. If you want to use the SAP digital payments add-on, the relevant ABAP system must be able to make a connection using TLS 1.2 (or higher). If your consumer application is an on-premise application. Please refer SAP Note 510007 – Additional considerations for setting up SSL on Application Server ABAP. Creating user account procedure may be different for each Payment service providers.

2. Setup Activities

A. Activating PSP

B. Consumer Applications

C. Account Setup

D. Connecting to PSPs

E. PSP Determinations

3. PCI Compliance and Security

A. PCI Compliance

B. Data Protection and Privacy

Card Payments in SAP S/4HANA on-premise – Configuration Tasks

A. Financial Accounting Setup

B. Payment Information Setup

C. Technical Integration

A. Financial Accounting Setup

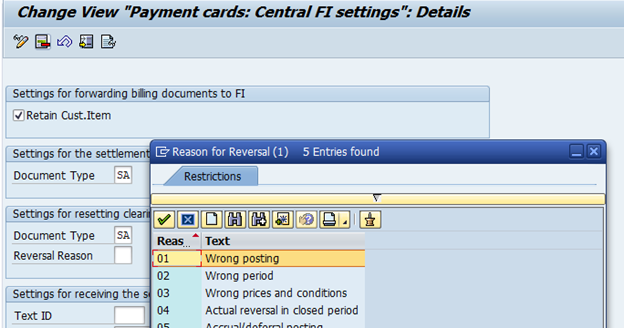

SPRO → Financial Accounting → Accounts Receivable and Accounts Payable → Business Transactions → Payments with Payment Cards → Make Central Settings for Payment Cards

Settings that are needed for payments using payment cards are done here

• We determine whether the customer item is retained in the accounting document when transferring data from Sales and Distribution (SD) to Financial Accounting (FI).

• We specify the type of settlement document if settlement is made by the payment card company. The settlement document clears the open items in the G/L account and generates items in a cash clearing account.

• Here, we specify a document type for resetting cleared items if settlement cannot be made by the payment card company.

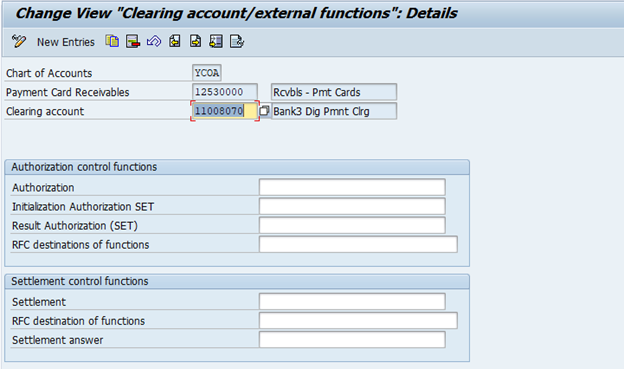

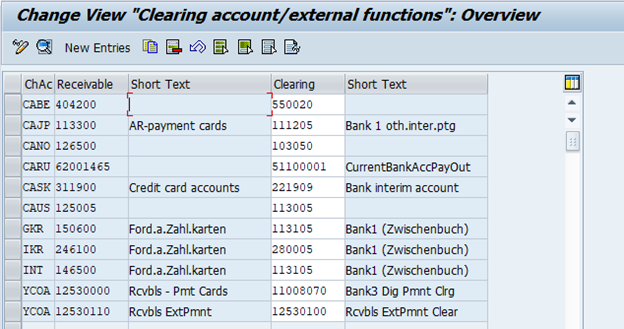

Assign the G/L account that records open items per credit card type to a cash clearing account

Financial Accounting → Accounts Receivable and Accounts Payable → Business Transactions → Payments with Payment Cards → Assign G/L Account to Cash Clearing Account

Save

G/L account records all the receivables that you report to the credit card company using a settlement program.

The settlement program posts the reported open items against the cash clearing account and clears them.

A G/L account kept on an open item basis and a cash clearing account must already be created.

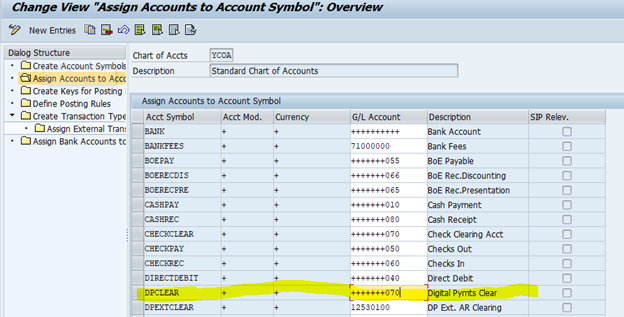

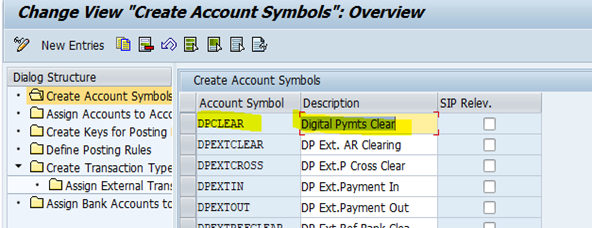

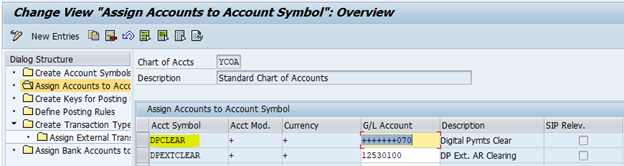

The clearing account of the payment service provider corresponds to the account symbol DPCLEAR.

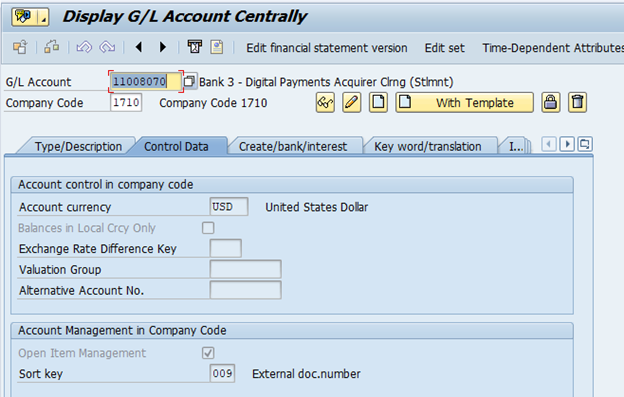

You create a virtual bank/bank account with the corresponding account in the system for digital payments.

One house bank can be created for the bank master record of the virtual bank and that only one virtual bank account is permitted per currency. To do this we create the corresponding bank clearing accounts as usual. Main bank account must end with “00” and this must be defined for the corresponding house bank account in Bank Account Management.

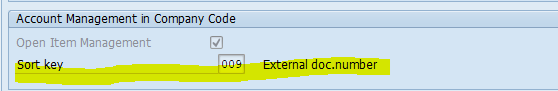

When setting up the G/L account for payment service provider clearing Account, we set the sort key to “External Document Number.”

Basic settings for the account statement processing

Financial Accounting → Bank Accounting → Business Transactions → Payment Transactions → Electronic Bank Statement → Make Global Settings for Electronic Bank Statement

Below points are to be configured

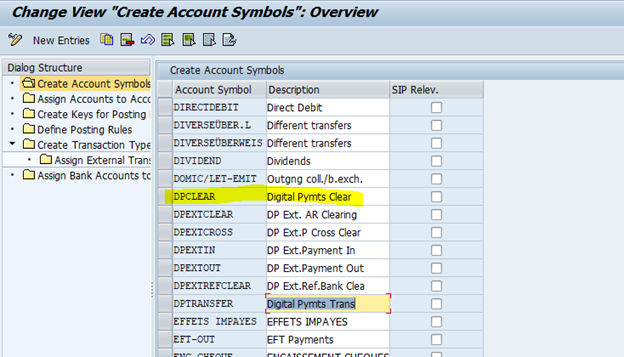

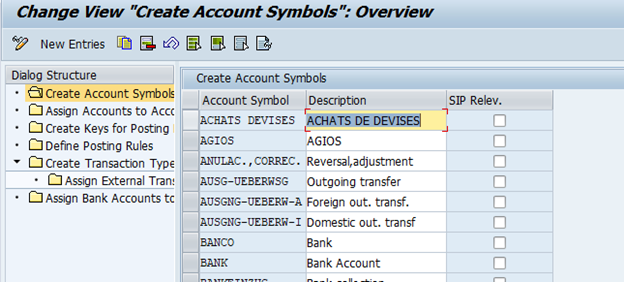

A. Create account symbol

We can create below account symbols

• Digital Payments Clearing

• Digital Payments Fee

• Digital Payments Transfer

B. Assign accounts to account symbols

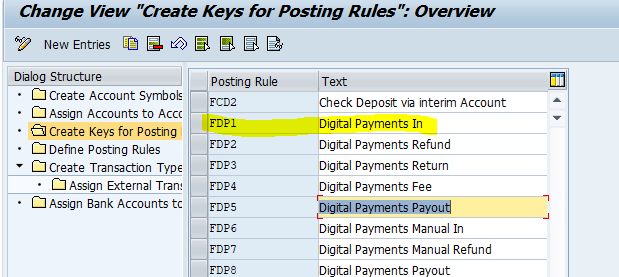

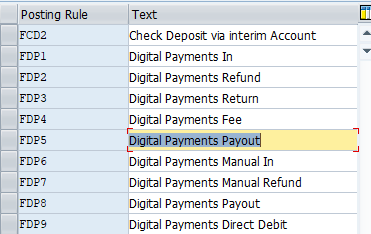

C. Create keys for posting rules

Please refer to SAP Note 2524512 to prepare 4HANA on-premise system.

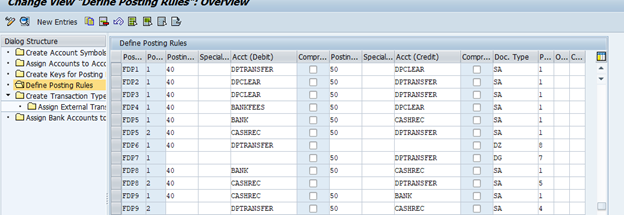

D. Define posting rules

E. Create a transaction type

F. Assign bank accounts to transaction types

To facilitate credit card payments with SAP digital payments add-on in SAP S/4HANA on-premise, configuration is needed in the Sales & Distribution area.

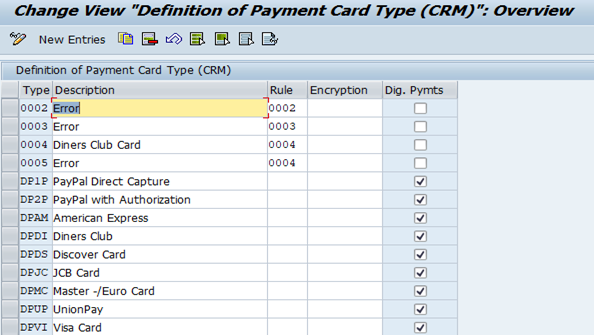

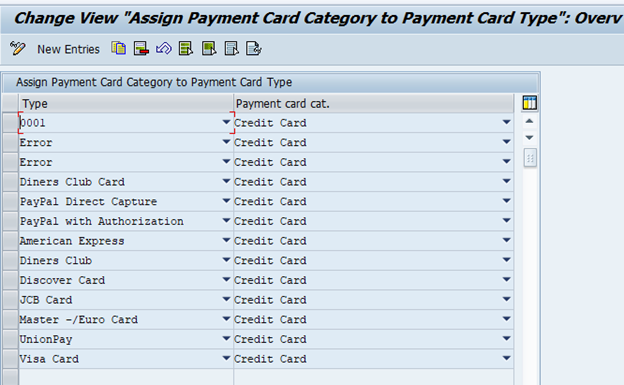

Below are some of the configuration settings to execute credit card payments with “SAP digital payments add-on”: SPRO → Cross-Application Components → Payment Cards → Basic Settings → Maintain Payment Card Type

Create new payment card types & assign the defined check rules to the payment card types. Create only one payment card type per credit card institution.

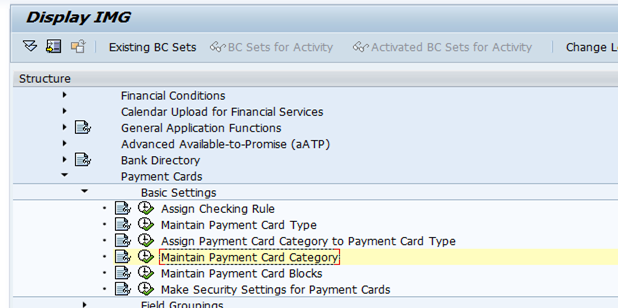

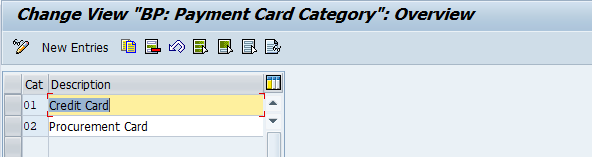

Maintain Payment Card Category

Then Assign Payment Card Category to Payment Card Type

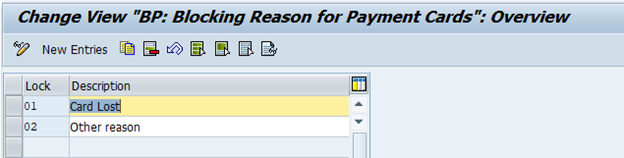

Create blocking reasons for card payments

SPRO → Cross-Application Components → Payment Cards → Basic Settings → Maintain Payment Card Blocks

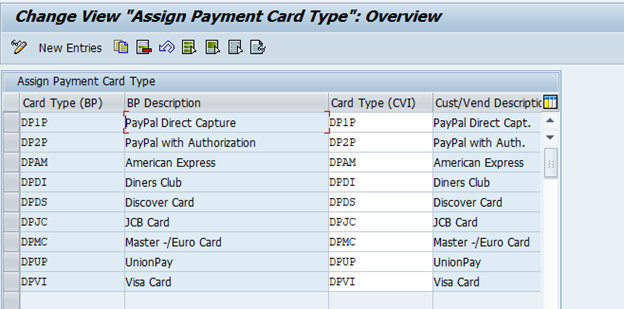

Assign the card types of payment cards for the customer master records to the payment card types for the business partner.

SPRO → Cross-Application Components → Master Data Synchronization → Customer/Vendor Integration → Business Partner Settings → Settings for Customer Integration/Vendor Integration → Field Assignment for Customer/Vendor Integration → Assign Attributes → Assign Payment Cards area

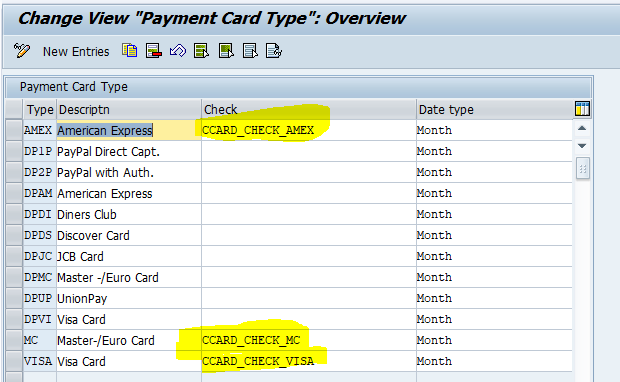

Sales and Distribution → Billing → Payment Cards → Maintain Card Types

Specify the type of check that the system carries out on a card number. Specify a date type

The standard system contains three card types and their check functions:

American Express and its function CCARD_CHECK_AMEX , MasterCard and its function CCARD_CHECK_MC , Visa and its function CCARD_CHECK_VISA

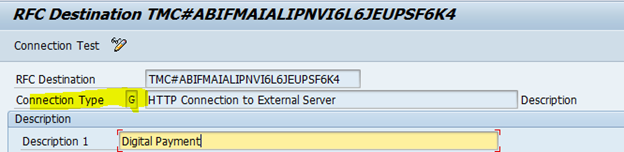

Technical Integration

We need to set up the technical connection to “SAP digital payments add-on”.

For this, define two RFC connections of the relevant type at transaction SM59.:

Setup a first RFC connection using the connection type G – HTTP Connection to External Server.

Establish a second RFC connection of type G – HTTP Connection to External Server.

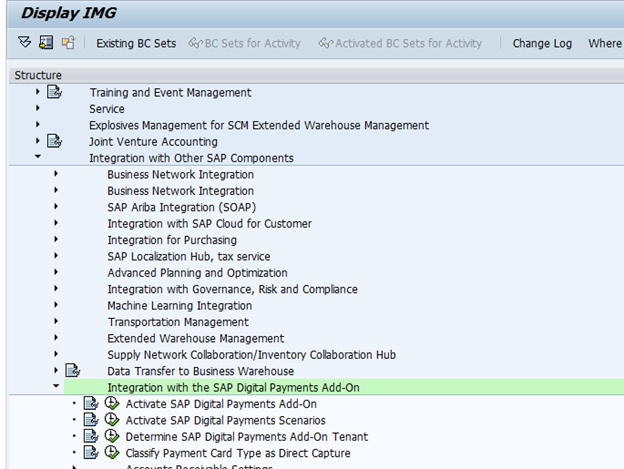

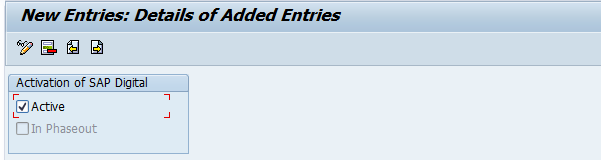

Activate the integration for “SAP digital payments add-on” in the system configuration.

You have now connected the S/4HANA system with your SAP digital payments add-on and activated it.

Further settings are required in accordance with the selected scenarios.

Configuration for Processing Credit Card Payments in SAP S/4HANA on-premise

Two important Configuration setups needed

1. Outgoing payments

2. Process Integration

Out Going Payments

SPRO → Financial Supply Chain Management → Biller Direct → Process Integration with Accounts Receivable Accounting → Release Payment Methods.

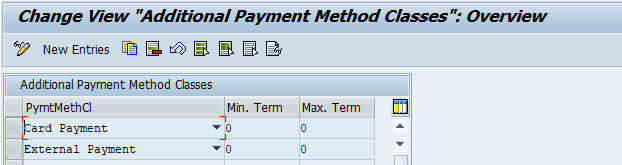

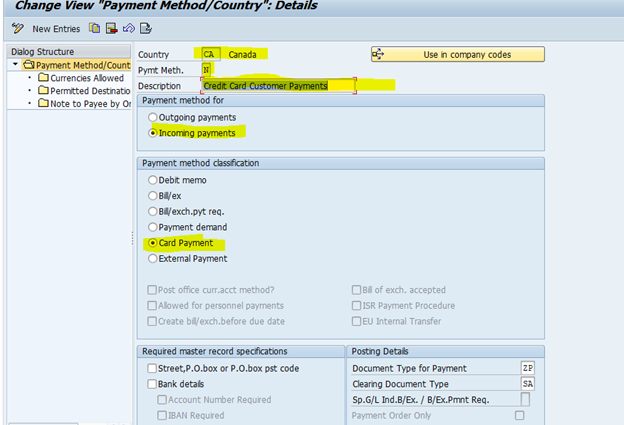

Define a payment method for credit card payments.

SPRO Financial Accounting → Accounts Receivable and Accounts Payable → Business Transactions → Outgoing Payments → Automatic Outgoing Payments → Payment Method/Bank Selection for Payment Program.

Set Up Payment Methods per Country for Payment Transactions . Define the payment method for the relevant countries.

Set Up of the credit card processing for SAP S/4HANA Cloud for customer payment.

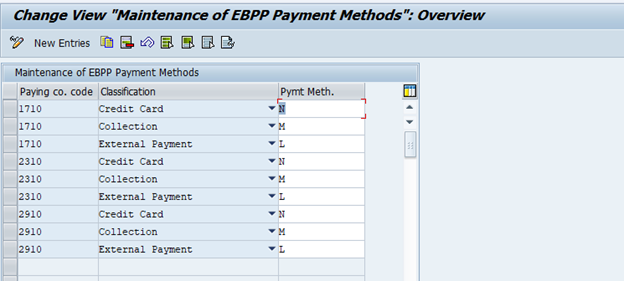

We need to determine which payment method is to be used for the credit card & bank collection & external payment.

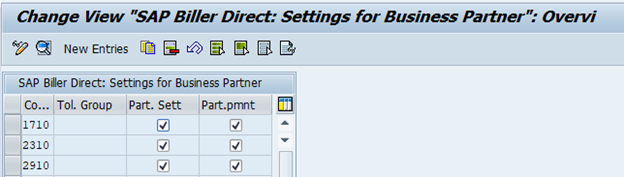

SPRO Financial Supply Chain Management -> Biller Direct -> Process Integration with Accounts Receivable Accounting -> Edit Payment Methods

New entry for every relevant paying company code is needed.

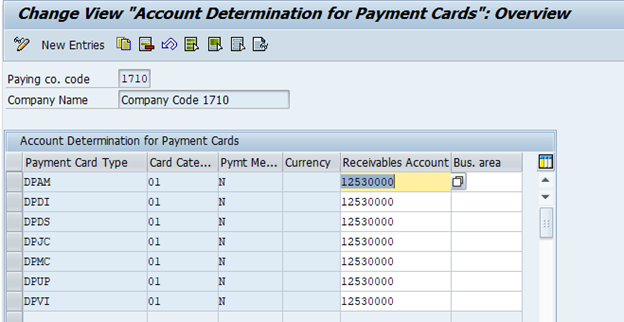

Account Determination for Payment Cards are based on the card type, the payment method and the currency, Provide G/L account on which you collect the receivables due from the credit card company.

SPRO Financial Supply Chain Management → Biller Direct → Process Integration with Accounts Receivable Accounting → Set Account Determination for Credit Cards.

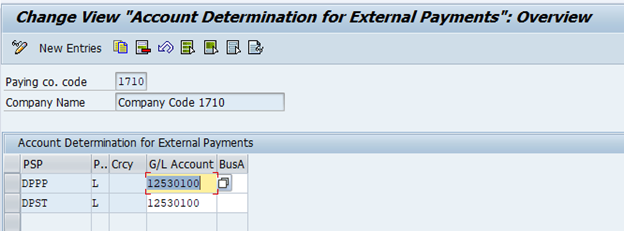

Configure Account Determination for External Payments.

SPRO → Financial Supply Chain Management → Biller Direct → Process Integration with Accounts Receivable Accounting → Configure Account Determination for External Payments to perform this task.

Depending on the payment service provider, enter the payment method and the currency of the G/L account on which you collect the payments.

Partial Payments

SPRO Financial Supply Chain Management → Biller Direct → Process Integration with Accounts Receivable Accounting → Define Partial Payment and Currency

• Allow partial payments for payment

• Allow partial settlement of credits for payment

• Currency for bills and credits

• Determine posting logic for partial payments

• Determine minimum payment amount for partial payments

• Allow discount for partial payments

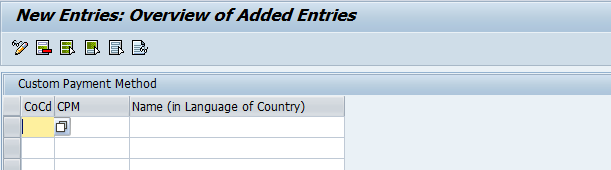

Edit Custom Payment Method

SPRO Financial Supply Chain Management → Biller Direct → Process Integration with Accounts Receivable Accounting → Edit Custom Payment Method

For each paying company code that permits payments via Cloud for customer payments, enter a payment method and a description. You can enter only payment methods for incoming payments.

About the Author:

Dr. Ravi Surya Subrahmanyam is a technical and Financials writer with a background in SAP Financial Accounting, Funds Management, Group Reporting, Financial Supply Chain Management, Cash Management & in-house cash, SAP S/4 HANA Finance. He has been working as a Director for the SAP Practice for The Hackett group India Ltd, (Answerthink Company). He completed his Master’s degree in Finance from Central University, Master of Commerce from Osmania University, Master of Commerce from Andhra University, and Ph.D.in Finance from one of the best universities in India. His research Papers have been published in National and International magazines. He has been a Visiting Instructor for SAP India Education and SAP Indonesia – Education. He has been working on Conversion and Upgradation projects. He is a Certified Solution Architect for SAP S/4 HANA and an SAP S/4 HANA Certified Professional. He can be reached at sravi@answerthink.com or fico_rss@yahoo.com

Stay tuned for more insights on Eursap’s Blog…

Please also check out Eursap’s weekly SAP Tips!

Get in touch with Eursap – Europe’s Specialist SAP Recruitment Agency