Migrate Classical SAP Profit Center Accounting (PCA) to Profit Center Accounting on ACDOCA

Introduction

Classical Profit Center Accounting (PCA) is part of the SAP S/4HANA compatibility scope, which comes with limited usage rights and may expire over a period. This means that customers who are using EC-PCA need to migrate from Classical Profit Center Accounting to its designated alternative functionality “Profit Center Accounting on Universal Journal” in SAP S/4HANA before expiry of the compatibility pack licence.

SAP recommends customers map Profit Center Accounting in the universal journal in SAP S/4HANA. When you use the SAP S/4HANA on-premise edition, it is possible in principle to use classic Profit Center Accounting in parallel with Profit Center Accounting in the universal journal. However, SAP do not recommend customers do this on a long-term basis due to the increased data volume and the increased time and effort required. In this article I would like to provide an overview of the migration process from EC-PCA to Profit Center on ACDOCA.

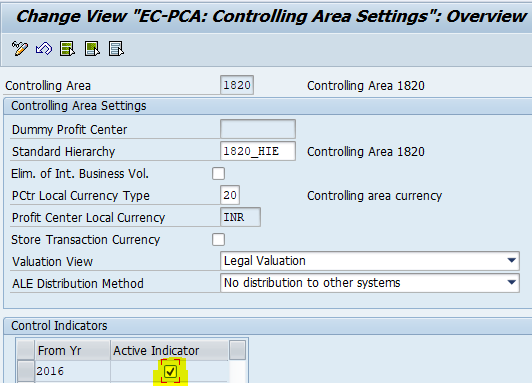

Verify whether Classic PCA in SAP S/4HANA is active in SAP S/4HANA or not?

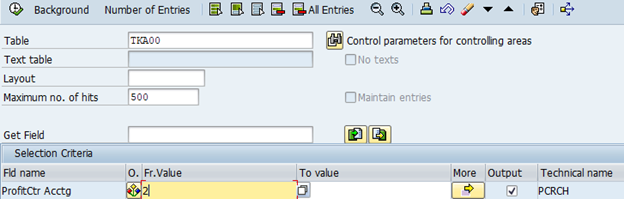

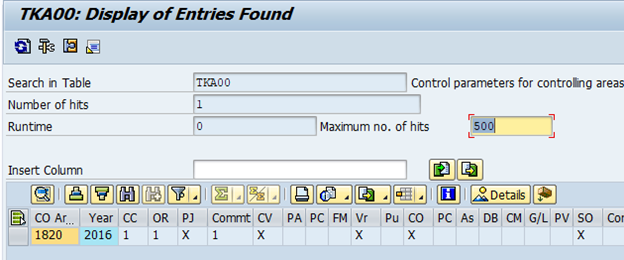

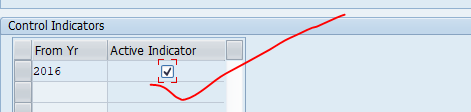

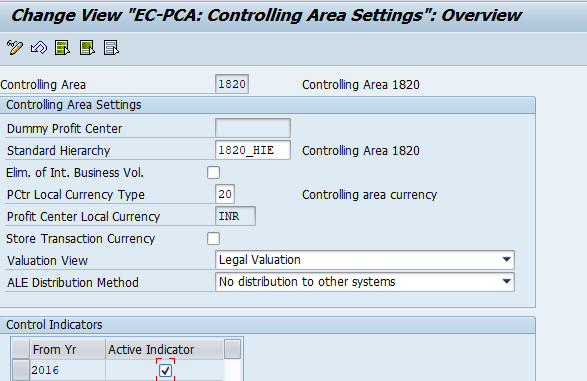

Classic PCA in SAP S/4HANA is active if the active indicator is set in transaction 0KE5 (field PCRCH for the corresponding controlling area in the table TKA00 is set to ‘2’).

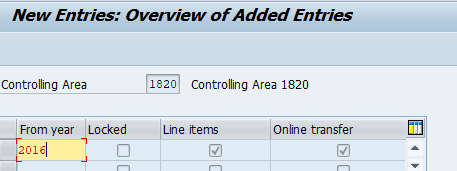

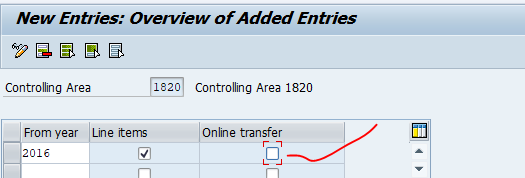

The online posting of data records in the tables (GLPCA = actual line items table, GLPCT = totals table, GLPCP = plan line items table) has been activated using transaction 1KEF.

How to verify if Profit Center Accounting is mapped in the universal journal in SAP S/4HANA?

In SAP S/4HANA, Profit Center Accounting is mapped in the universal journal by default.

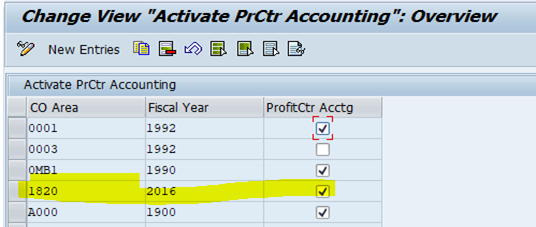

SPRO–>Financial Accounting –> General Ledger Accounting –> Master Data –> Profit Center –> Activate Profit Center Accounting in Controlling Area.

The activation in a controlling area sets the field PCRCH for the entry of this controlling area to the value ‘2’ in the table TKA00.

If a document is then posted in the universal journal that contains a profit center and, if applicable, also a partner profit center, these are checked for existence and updated in the tables of the universal journal – ACDOCA.

In addition, it is possible to continue to use classic Profit Center Accounting in SAP S/4HANA on-premise edition for a transition period. When the active indicator is set in transaction 0KE5, the field PCRCH for the corresponding controlling area in the table TKA00 is set to ‘2’, provided it has not already been populated with ‘2’ through the activation of Profit Center Accounting in the universal journal. This means that, simultaneously with the original activation of classic Profit Center Accounting (transaction 0KE5), Profit Center Accounting in the universal journal is also always active.

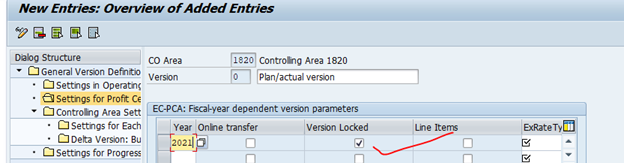

In classic Profit Center Accounting, in addition to the activation (transaction 0KE5), the online posting of data records in the tables (GLPCA = actual line items table, GLPCT = totals table, GLPCP = plan line items table) must be activated using transaction 1KEF. Actual documents are updated online in the database tables of classic Profit Center Accounting only if the ‘Online transfer’ indicator is set in transaction 1KEF.

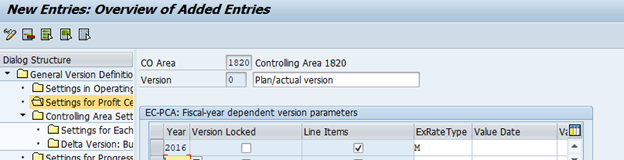

Plan: transaction OKEQ –> version 0 –> Settings for Profit Center Accounting). Classic Profit Center Accounting has the ledger ‘8A’ as a fixed ledger assignment

How to deactivate classic Profit Center Accounting later?

If you want to deactivate classic Profit Center Accounting later then we need to consider some important points:

1. Do not remove the activation of Profit Center Accounting in transaction 0KE5. If we do so, it will also deactivate Profit Center Accounting in the universal journal (table/field TKA00-PCRCH) so do not remove this setting.

2. Remove only the online posting of data records in transaction 1KEF (actual data).

OKEQ (plan data). However, data may still be transferred periodically to classic Profit Center Accounting. Therefore, you can also set the lock indicator in the year entry of transaction 1KEF or OKEQ.

Will the system allow Deactivating classic Profit Center Accounting if Transaction data exists in GLPCA and GLPCT?

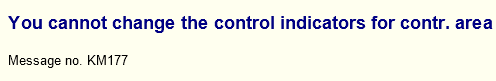

If data was already posted in the fiscal year, the system issues error message KM 177 (“You cannot change the control indicators for contr. area & in year &.”) in Transaction 1KEF.

![]()

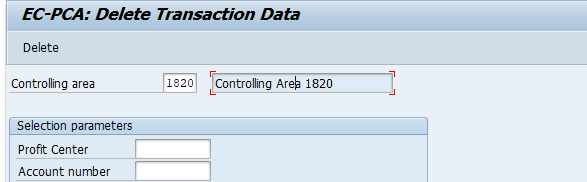

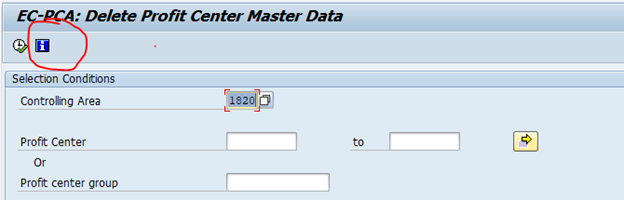

If you no longer need the transaction data you can delete it using customising transaction 0KE1, or you can archive it.

You can then remove the flag for the online transfer without an error message.

Do you want to deactivate the update to classic Profit Center Accounting without deleting or archiving the posted data?

This is possible if you have activated the profit center scenario and/or the segment scenario in a ledger of General Ledger Accounting (new). If you implement consulting notes 1503968 and 1639693, message KM 177 is displayed only as a warning message. In all other cases, the transaction data must first be archived or deleted.

Can I uncheck line item indicator in Transaction 1KEF??

If you have transaction data, you will not be able to remove the line item indicator initially. The system issues error message KM 177 “You cannot change the control indicators for contr. area & in year &.”. If you no longer require the transaction data, you can delete it using customizing transaction 0KE1, or you can archive it. You can then remove the line item indicator.

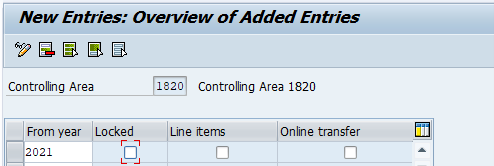

What happens If I maintain entry for year in Transaction 1KEF?

If there is a valid year entry, but no other indicator is set, totals data can be transferred periodically. If you set the ‘Locked’ indicator or remove the year entry, data can no longer be transferred to the classic PCA.

Continue to Set the ‘Active Indicator’ in transaction 0KE5 if you want to continue to use Profit Center Accounting in General Ledger Accounting (new) or in SAP S/4HANA. The active indicator of Profit Center Accounting activates a couple of additional checks that ensure the consistent derivation of the profit center during postings.

This also helps to warn users when they create a cost center or an internal order – a check is executed that prompts the user to enter a profit center.

To deactivate classic Profit Center Accounting, only the removal of the online transfer in transactions 1KEF (actual data) and OKEQ (plan data) is required. Alternatively, set the lock in the year entry or remove the year entry completely.

How about- PCA Profit center master data?

Never delete the profit center master data because this causes problems. For example, a deleted profit center is assigned to a material or a cost center for MM postings or CO postings. Deleted profit centers exist in posted documents that are processed further (for example, settlement or assessment). If you don’t need any of the profit center, we will be able to lock the master data.

Alternatively, you can also implement SAP Note 131557 and therefore completely deactivate the PCA Customizing check for the time during which objects and documents still exist with profit centers.

Can I delete the PCA transaction data from the PCA tables?

Preferably archive the transaction data or delete it using the customizing transaction 0KE1.

Can I delete the PCA master data?

Use the customizing transaction 0KE2 to delete the profit center. For more information, see the customizing documentation next to the “Execute” of the transaction.

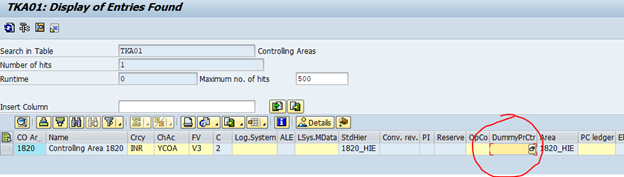

Can I delete Dummy Profit Center from 0KE5?

Dummy profit center: Initially, transaction 0KE2 does not delete the dummy profit center. To do this, execute the report that is attached to SAP note 702854. First, create the report in your system. This deletes the entry of the dummy profit center in the field DPRCT of the table TKA01.

This also removes the entry in transaction 0KE5 and the “Dummy Profit Center” indicator on the indicators tab of the master data transactions (KE52/KE53).

The profit center then remains in the master data with active status and can be treated in the same way as a normal profit center.

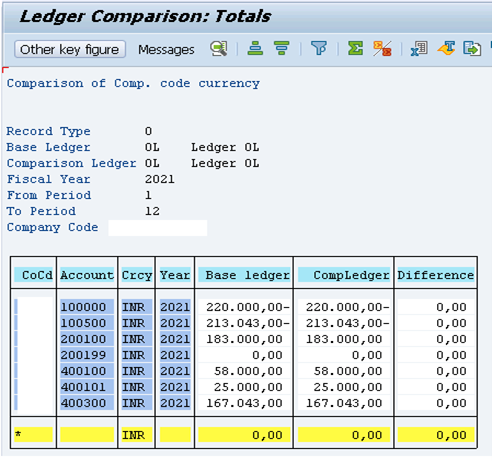

How to reconcile the ACDOCA (universal journal) with classic Profit Center Accounting (GLPCT)?

Transaction GCAC is available for the reconciliation of the data in the universal journal with the data in classic Profit Center Accounting. Here, you can select the leading ledger or a non-leading ledger of the universal journal as the base ledger. The ledger selected for the reconciliation should have the same fiscal year variant as the PCA ledger. As selection data for the comparison ledger, enter the ledger 8A and version ‘0’.

In SAP S/4HANA, the entry in table T882 is still relevant for the ledger 8A of classic Profit Center Accounting (as well as for ledgers used in FI-SL). However, only the field VTRHJ is used for the ledger 8A. In the field VTRHJ, the carry-forward year of the last execution of transaction 2KES (balance carry-forward PCA) is set. It is important for the correct execution of transaction 2KES. All other fields are irrelevant for processing in classic PCA. The local currency (HSL) is always derived from the information of the company code (table T001). The PCA local currency (KSL) is always derived from the information of the controlling area (table TKA01).

Do I need to migrate the data?

It is not necessary to migrate data from classic PCA (tables GLPCA/GLPCP/GLPCT) to the universal journal, that is, to the table ACDOCA when deactivating classical PCA.

Authorization objects?

The existing authorization objects are still available and valid.

Migration of allocations?

A migration of allocations from classic Profit Center Accounting to the universal journal is not possible.

Conclusions

An Experienced SAP S/4HANA consultant can help customers to migrate from EC-PCA to Profit Center Accounting on Universal Journal entry. When customers are migrating this needs to be tested meticulously before we move any changes to the Production system.

About the Author:

Dr. Ravi Surya Subrahmanyam is a technical and Financials writer with a background in SAP Financial Accounting, Funds Management, Group Reporting, Financial Supply Chain Management, Cash Management & in-house cash, SAP S/4 HANA Finance. He has been working as a Director for the SAP Practice for The Hackett group India Ltd, (Answerthink Company). He completed his Master’s degree in Finance from Central University, Master of Commerce from Osmania University, Master of Commerce from Andhra University, and Ph.D.in Finance from one of the best universities in India. His research Papers have been published in National and International magazines. He has been a Visiting Instructor for SAP India Education and SAP Indonesia – Education. He has been working on Conversion and Upgradation projects. He is a Certified Solution Architect for SAP S/4 HANA and an SAP S/4 HANA Certified Professional. He can be reached at sravi@answerthink.com or fico_rss@yahoo.com

Stay tuned for more insights on Eursap’s Blog…

Please also check out Eursap’s weekly SAP Tips!

Get in touch with Eursap – Europe’s Specialist SAP Recruitment Agency