Account Postings in SAP SD/Order to Cash

Account Postings in SAP SD/Order to Cash.

This article will review high-level account postings for following major documents of the Sales and Distribution Order-to Cash flow:

- Sales Order

- Delivery Document

- Delivery Document: Post Goods Issue

- Billing

- Accounts Receivable

I will be using very simple T account notation with round numbers for illustrative purposes. Precise GL Account numbers are not used in this article as specific systems may vary in this regard. But the essentials are all here. This article is meant to serve as a useful reference.

1. Sales Order

Order to Cash starts here. The Sales Order document makes the following impact on your company’s accounts:

Kind of a study in minimalism, you might say? That’s right. The mere creation of a legally binding order of goods or services to your customer has ZERO impact on your corporate books. Sales Orders do have other impacts (for example on item availability) but not to accounting.

2. Delivery Document

The second step in Order to Cash is to create a Delivery document. Here is the impact:

Please don’t get fidgety. Like Sales documents, a Delivery document does not in and of itself create Account postings. A Delivery document is simply a proposal of the actual goods movement to be performed later on at the critical step of “Post Goods Issue.” Within the delivery processes are various sub-steps like picking, packing, and messing with handling units, but these also do not create Accounting entries.

3. Delivery Document: Post Goods Issue

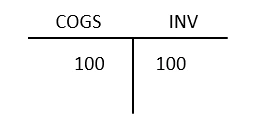

The Post Goods Issue is the last part of the Delivery process. This is where the rubber hits the road, from an Accounting perspective:

We have entries! This is due to the fact that ownership of the goods is transferred at this stage. Assuming that your goods were worth $100, your Cost of Goods Sold Account is debited $100 and, to balance, Inventory is credited $100. This matches what actually happens. Your Cost of Goods Sold is increased by $100. Your inventory is reduced by the value of the goods out the door.

4. Billing Document

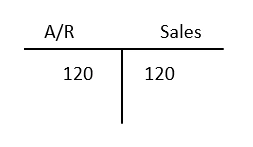

When you’re creating invoices to customers, the following corporate accounts are affected as follows:

This time we are adjusting our $100 amount upwards to reflect the fact that, as a business, we mark up the cost of goods. Put another way, goods that cost us $100 will typically sell to your customers for, say, $120. So we will debit our customer’s Account Receivable account by $120. This will be paired with $120 credited to our Sales revenue account. This will offset the $100 COGS debit from the previous step with an extra $20 left over to allocate to gross profits. As a bonus, we will now look at the next step in Order to Cash which takes place in the FI module, the Accounts Receivable posting.

5. Accounts Receivable Document

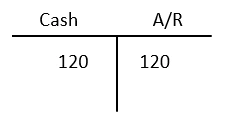

So what happens when your customer pays your invoice? The inbound cash is a debit to your cash account (put another way, your cash account goes up $120). This is matched with a corresponding credit to your open Accounts Receivable. This offsets the corresponding debit from the previous step, effectively closing it out.

At a very high level, this is the happy ending to our order-to-cash story. Your customer wanted a product that you sell. They placed the order. You wrote them a sales order. The order was delivered and invoiced. Finally, the customer settles the invoice with payment. This is the essence of all commerce in an SAP S/4HANA format.

For more information on this important topic, please refer to my recently published book, “Sales and Distribution with SAP S/4HANA - Business User Guide,” cowritten by one of the UK’s leading SAP SD consultants Jon Simmonds.

As a special bonus to EURSAP blog readers, please use this code SDEUG15 for a 15% discount!