How to prepare for SAP FI-AA (ECC to SAP S/4HANA) Conversion

Prepare your SAP ECC System for SAP S/4 HANA Conversion Prerequisites for SAP FI AA Conversion

Abstract

When you have successfully moved to SAP S/4 HANA Finance, you can take advantage of a single, universal journal entry table, that you can access with great speed and that you can report on with confidence. When you report a number, either for management reporting or for financial reporting, it’s one number and one source of truth. Running your reporting out of a real-time system, means you no longer have to rely on stale old data.

Fiori & HANA is great combination that starts to re-imagine ERP processes, especially within SAP S/4 Finance, bringing a user experience that’s modern, role-based, & responsive together. SAP Customers will certainly appreciate the increased simplicity when they move from SAP ECC to SAP S/4HANA.

SAP S/4HANA Finance (formerly known as “SAP Simple Finance”) runs on the SAP HANA in-memory computing platform, optimizing transaction processes, and allowing you to run on-the-fly analysis, with scalable, real-time, and predictive data. Users can drill down to the finest level of granularity with great responsiveness. It offers a simplified data model and a sleek Fiori user interface. SAP S/4HANA allows you to digitize and allows you to realize an end-to-end digital business with the capabilities necessary to achieve digital transformation. This next-generation business suite breaks the limitations of the past SAP ECC versions with a simplified data model, Parallelism of tasks (more throughput of data), faster processing, and enables real-time responses. It’s no wonder that so many SAP Customers, with large volumes of data, wanting to extract information quickly and create meaningful reports, are moving to SAP S/4HANA.

In this article, I will share my experiences by highlighting the preparation steps needed in relation to the Asset Accounting Module when converting an SAP ECC system to SAP S/4HANA.

SAP S/4 HANA Conversion:

To get the capabilities of SAP S/4HANA, an SAP ERP (ECC) system has to be converted in to SAP S/4HANA. In this case, you have two situations. the business is already using an SAP HANA database or the business is using SAP ECC with another database. In either case, there is no disruption to existing business processes or need to go for re-implementation to get the functionalities of SAP S/4HANA. When the system is converted, you can re-evaluate the existing business processes and make changes to business processes to fit the digital economy. To identify the likely duration of the conversion project, please consider both technical and functional aspects (company codes, Ledgers …. Etc) of the system and the number of systems to be converted to SAP S/4HANA.

As with a new implementation, with a system conversion you can experience a trial of SAP S/4HANA to get an idea of the new innovations and explore the business processes you might want to adopt on top of your converted SAP S/4HANA system.

Preparation is Everything!! – Success is the result of Perfect Conversion Preparation!!

Be prepared – Fixing it in Production is a Fantasy!

The success of any Conversion project is based on perfect preparation for General Ledger Accounting, Asset Accounting, Controlling, Material Ledger, Credit Management, House Banks and so on. Consultants working on such conversion projects must be ready to learn from failures, errors and warning message issues for each module.

For SAP S/4HANA Conversions, during preparation Phase and realization phase, Consultants will do the technical and functional preparation tasks on the ECC system (Source System). Below, I will focus on the tasks that are needed for the Asset Accounting Module specifically.

Before deciding to convert your SAP ECC 6.00 (Any EHP 0 to 8) system to SAP S/4HANA, Firstly, you need to be aware of system requirements, then you need to be aware of system landscape adaptations, so you will know if your current SAP system is suitable, technically and functionally for conversion in one step. (Refer to Start Releases and Conversion Paths in the conversion Guide provided by SAP).

Before executing the SUM tool, Asset Accounting Consultants must ensure that the prerequisites for Asset Accounting are met. The Simplification Item-Check report provided by SAP will verify Controlling, General Ledger and other modules to convert ECC to SAP S/4HANA, but Asset Accounting checks are not included in this report.

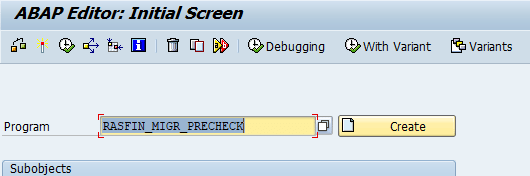

To run pre-checks for Asset Accounting on your SAP ECC system before you use the SUM tool for technical Conversion, Asset Accounting consultants must execute the report RASFIN_MIGR_PRECHECK and implement the SAP Notes listed in the collective SAP Note 2333236.

The report RASFIN_MIGR_PRECHECK is to be executed separately in each client, not through Transport request. If a consultant performs the conversion and activates new Asset Accounting, without dealing with errors or warning messages, they may end up unable to return to their original classic Asset Accounting and also unable to repair data inconsistencies after conversion.

As per my experience and knowledge, below are the steps that are to be performed in your ECC system before you execute the SUM tool. These steps are the prerequisites for the use of new Asset Accounting.

The following activities are relevant for you if you have been using classic Asset Accounting in SAP ECC or New Asset Accounting in SAP ECC, up to now, and you now want to Convert your system to new Asset Accounting in SAP S/4HANA 1709:

Preparations in SAP ECC (Before SUM installation) – (1):

Preparation steps may be related to Configuration or Verification. You may need some additional adjustments in your configuration settings to meet the prerequisites for the ECC to S/4HANA Conversion. This needs to be done as per the Simplification Guide & Conversion Guide. These activities are to be done before installing the SAP S/4HANA (SUM Execution).

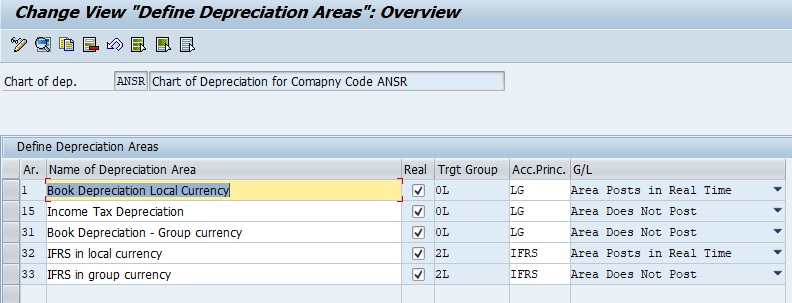

You may need to make adjustments for your chart of depreciation:

• Verify Existing Depreciation areas in Chart of Depreciation

• For every additional currency type defined on the company code a corresponding depreciation area needs to be set up (Configure additional Depreciation areas if necessary based on Currencies) (

• If you have previously been using parallel currencies in General Ledger Accounting, but you have not implemented the corresponding parallel currency areas in Asset Accounting for all depreciation areas, you must first implement these depreciation areas before you install SAP S/4HANA.

• Don’t delete any derived depreciation or delta depreciation areas. Just assign an accounting principle and ledger and set “does not post”.

• Verify / Define correctly, ledgers and ledger groups.

• Define Accounting Principles

• Assign the accounting principles to ledger groups.

• Assign ledger and an accounting principle to the company codes used in Asset Accounting.

• An accounting principle should be assigned to each depreciation area, even the non-posting depreciation areas. The system derives the accounting principle from the relevant ledger group that is already assigned to the depreciation area.

• Change posting indicator for posting to the general ledger for depreciation areas.

If, you are using classic Asset Accounting with classic General Ledger Accounting or classic Asset Accounting with New GL you have to make the following preparations:

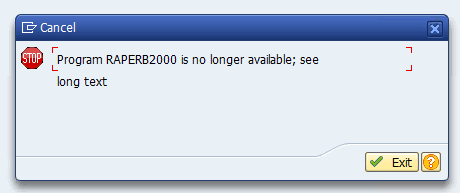

• Make sure that period-end closing was performed ( RAPOST2000, RAPERB2000 Etc) reconciliation of the asset subsidiary ledger with the general ledger (account balance list and asset list, RAABST01, RAABST02) are completed without any errors or imbalance. If you are doing the conversion at the last period of the fiscal year (Year-end) you need to close off the Asset fiscal year, you should also perform year-end closing. So, All periodical APC postings are to be completed (program RAPERB2000), If you don’t do this in the ECC system, you will not be able to post in your S/4HANA system as this program is obsolete. Please see below screen print from an S/4HANA system:

• Depreciation posting must be completed for that month

• Month end closing or Year-end closing ( as the case may be) must be completed

• Only one fiscal year in AA is open

• Verify FI-AA Consistency Check / Reconciliation to make sure FI and AA are consistent in every client.

Perform pre-check report RASFIN_MIGR_PRECHECK to make sure that all prerequisites are fulfilled and ready for SUM execution for conversion

Use Case 1:

If your ECC system Release is SAP_FIN 617 SP03 or lower, or SAP_APPL 617 SP03 or lower, you must implement SAP Note 1939592 and all relevant SAP Notes to be able to start the report.

Pre-Check Report for Asset Accounting Conversion to New Asset Accounting will be found from SAP Note 1939592. It has delivered the report RASFIN_MIGR_PRECHECK.

Use Case 2:

If your ECC system Release is SAP_FIN 617 SP04 or higher, the report is already implemented in your system. You only have to implement the missing SAP Notes to be able to verify Asset Accounting convertibility.

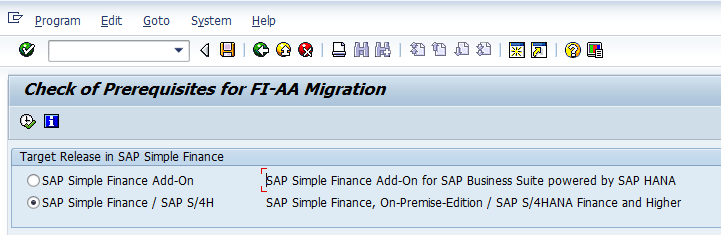

When you execute the report via SE38, your system should show the screen below:

Then Execute:

• Select option 2, that is “SAP Simple Finance or SAP S/4HANA”, as you will be doing SAP S/4HANA 1709.

• The first option is only for the checks relevant for SAP Simple Finance Add-On 1.0 (so it is not the correct option for 1709)

• You must execute this report in all clients in which the data should be migrated to SAP S/4HANA. (First Execute in Sandbox (Copy of PRD), Then DEV, then QAS then PRD)

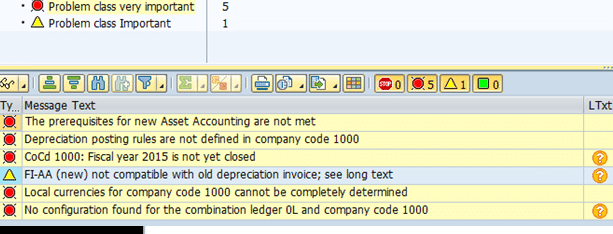

If your receive any errors or warning messages (such as those you see as above), you must readjust all the configuration settings and re-run the same report.

After Rectification of errors:

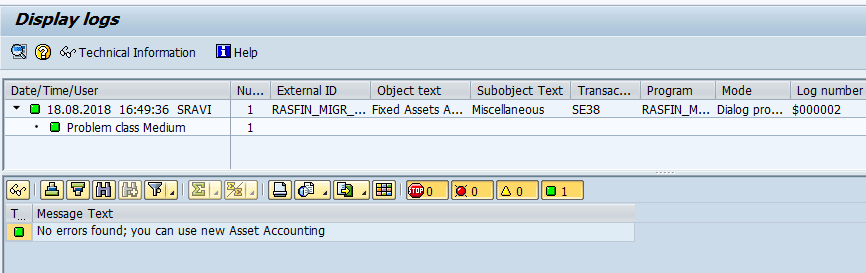

After fixing all of the above configuration settings, You should execute the same report again until you have no errors found (like below):

Now you are good to move on…

• Lock Users, avoid posting further.

• Take some Asset Reports for Validation after SAP S/4HANA Conversion.

• Issue the system for SUM execution

Preparations and Migration of Customizing for Asset Accounting – (2):

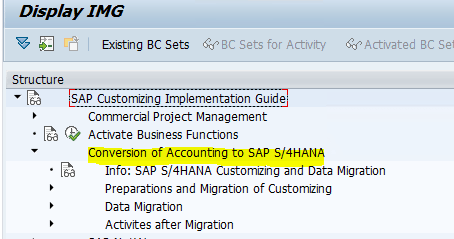

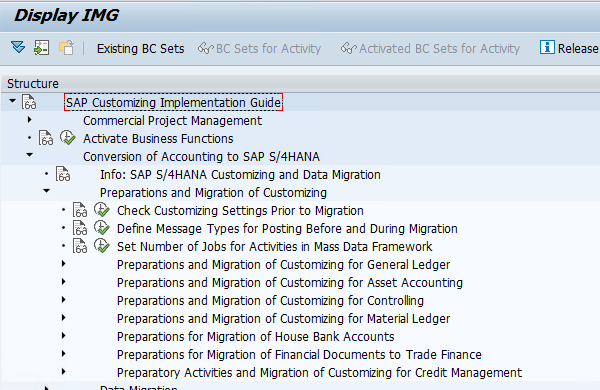

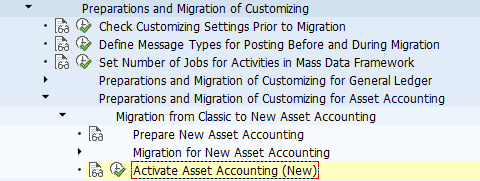

When you successfully execute the SUM tool, the SAP S/4HANA system shows the new IMG structure Asset Accounting in the SAP Reference IMG. You can see it in the SAP S/4HANA Conversion Cockpit.

The first step in the Conversion cockpit is Preparation. The preparation step has the below sequence:

The first step in Preparation is “Preparations and Migration of Customizing for General Ledger”. Once we execute this step without any errors, we need to move to Asset Accounting preparations.

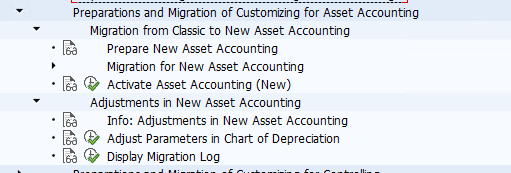

Consultants responsible for Asset Accounting should start the next step in the Preparation: “Preparations and Migration of Customizing for Asset Accounting”

Migrate the charts of depreciation for new Asset Accounting.

If the Configuration settings are correct in ECC and you execute the step to Migrate your chart of depreciation, your sample chart of depreciation appears as below:

(Migration of chart of depreciation (e.g. ledger approach, automatically)

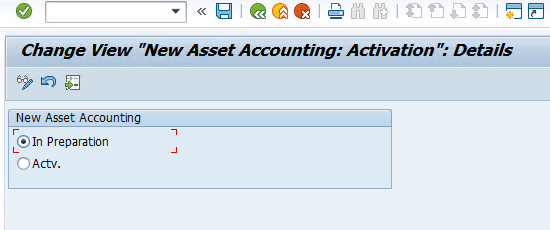

Once the chart of depreciation is successfully migrated, we need to Activate Asset Accounting (New) in the step below:

Execute Activate Asset Accounting ( New) IMG button:

Activate and save.

Then we must make additional manual setting adjustments in Customizing for new Asset Accounting as necessary.

New Customizing needs to be set up (Not all are mandatory—Depending on your customer specifics, additional customization may need to be done)

• Account approach: Define Asset Balance Sheet Accounts of Parallel Valuation as Reconciliation Accounts

• Quantity update: define depreciation area (Optional Step)

• New account technical clearing account for integrated asset acquisition (Required Step)

• Specify alternative document type (Optional Step)

• Revenue distribution for retirement by APC or net book value (Optional Step)

• Post net book value instead of Gain/Loss (Required Step)

• No restriction of Transaction Types to depreciation areas (Required Step)

Migration Monitor: (Start and Monitor Data Migration):

This Monitor migrates the transaction data of General Ledger Accounting and Asset Accounting to ACDOCA table ( Universal Journal Entry table).

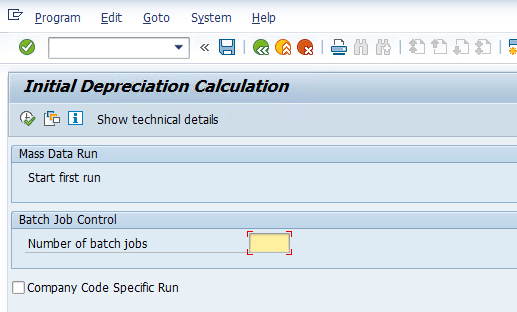

Final Step for Asset Accounting Conversion is Calculating Initial Depreciation Values:

After performing the Migration of Customized data for Asset Accounting, activating new Asset Accounting, migrating the transaction data of General Ledger Accounting and Asset Accounting we will execute this step.

Conclusions & Recommendations:

Having an “I can do anything” attitude is great, but it is important to remember to prepare! From my experience in Conversion and upgrade projects, I have learnt that preparation is key:

• Preparation for Conversion in ECC (Your source System)

• Preparation and Configuration for Conversion (Conversion Cockpit Preparations)

• Preparation for Executing Conversion Monitor (like Analyzing transaction Data etc).

In SAP S/4HANA Conversion Projects, Preparation is everything! Every Consultant working on such Conversion projects must make sure every task specified in Conversion guide and simplification guide has been covered and everything is addressed. You will find great difficulties if you ignore something in preparation phase, thinking you’ll be able fix the problem in production after conversion instead. Fixing an error or data inconsistency post conversion is a nightmare – Get it right before production system conversion if you want it to be done well.

If you found this Blog post useful, you may also like to read:

The unexpected challenges of an SAP S/4HANA implementation

How to use SAP Activate for your SAP S/4HANA Roadmap

Good luck with your SAP S/4HANA Journey!

Author: Dr Ravi Surya Subrahmanyam – SAP Certified S/4HANA Solution Architect

Need to hire SAP S/4HANA resources?

Get in touch with Eursap – Europe’s Specialist SAP Recruitment Agency