Implications of Brexit for SAP ERP

Implications of Brexit for SAP ERP.

"Failing to prepare is preparing to fail"

Brexit, especially the possibility of a Hard Brexit, has been a hot-topic in the news for a long time having been a key source of risk and ambiguity for businesses operating in the UK (United Kingdom) and EU (European Union). As any ERP is the heart of operations for an organisation, readiness in terms of hard Brexit is key to mitigate any operational risks which businesses might face come the end of October.

In this blog series, we will cover some of the key aspects in relation to SAP and how to handle a Hard Brexit scenario. In this first blog article, we will cover off some of the key areas. We will follow a Q&A approach for this.

What Is Brexit?

Brexit is an abbreviation for "British exit," referring to the UK's decision of the 23rd June 2016 referendum to leave the EU.

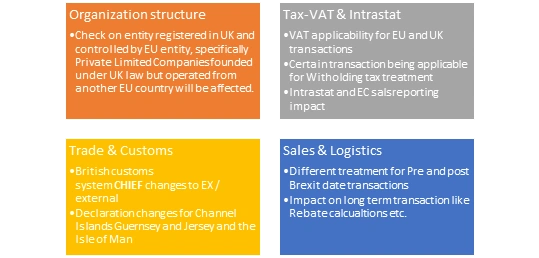

What are the key areas of impact for SAP in the case of a Hard Brexit?

Below are some of the key areas (not a complete list) of the areas which will be impacted by a Hard Brexit.

What is the impact on Tax in case of Hard Brexit?

Tax is a significant area of impact in case of a Hard Brexit. To answer this question, we will break the response into key areas/topics where Hard Brexit will have an impact. We will provide key points under each together with the possible solutions provided by SAP:

Tax master data/ configuration

- Hard Brexit will have impact on multiple key master data for organisations.

- Tax codes for EU businesses in the TAXGB tax procedure will have to be reviewed, as no intracommunity business can be done any more from within a UK company, and some new tax codes will have to be created. Please review SAP Note 2763478.

- Change in country definition-Deactivation of EU-flag for UK in table T005 (please note that you will need a interim solution to manage any open order- refer SAP note-2763478).

- Update VAT registration numbers in EU Member States commonly maintained in field "STCEG" in customers and vendors master data. GB registration will have to move to a separate field.

Withholding tax

- As the Parent Subsidiary Directive and the Interest and Royalties Directive will no longer be applicable some transactions will become subject to withholding tax.

- Businesses need to check transactions with UK companies (dividends and interest or royalty payments in particular) if they become relevant for withholding tax.

- Configure withholding tax if applicable.

Indirect tax / VAT

- Indirect tax reporting will be impacted and new tax code / tax procedure needs to be setup.

- There will be a scenario for "postponed accounting" introduced by the UK government, UK VAT registered businesses importing goods to the UK will be able to account for import VAT on their VAT return, rather than paying import VAT on or soon after the time that the goods arrive at the UK border. This will apply both to imports from the EU and non-EU countries.

- There will be impact on VAT for some of the transactions e.g. where there is a subsequent change in base amount e.g. payment with discount and these become subject to intra-stat reporting (after the hard Brexit date).

Other tax reporting topics

- The EU sales listing in the UK will remain for the return of Hard Brexit date with the reporting of the intracommunity transactions until the "hard" Brexit date and it will become obsolete afterwards.

- Intrastat declarations in the UK will remain for the return of Hard Brexit date with the reporting of the relevant transactions until the Hard Brexit date and it will become obsolete afterwards.

Industry specific tax

- Certain industries e.g. publishing (books mainly) which uses MOSS tool for reporting will have an impact after Brexit.

- If the UK leaves the EU with no agreement, businesses will no longer be able to use the UK’s Mini One Stop Shop (MOSS) portal to report and pay VAT on sales of digital services to consumers in the EU. Businesses that want to continue to use the MOSS system will need to register for the VAT MOSS non-Union scheme in an EU Member State. This can only be done after the date the UK leaves the EU on the Hard Brexit date.

As a business we import and export to EU member states; what will be the impact on this?

The question is multi-faceted and involves many components, namely:

- Key aspects of trade declarations impacted by a Hard Brexit

- Impact on solutions used in the client landscape for trade & custom declarations

- Possible remedies and measures

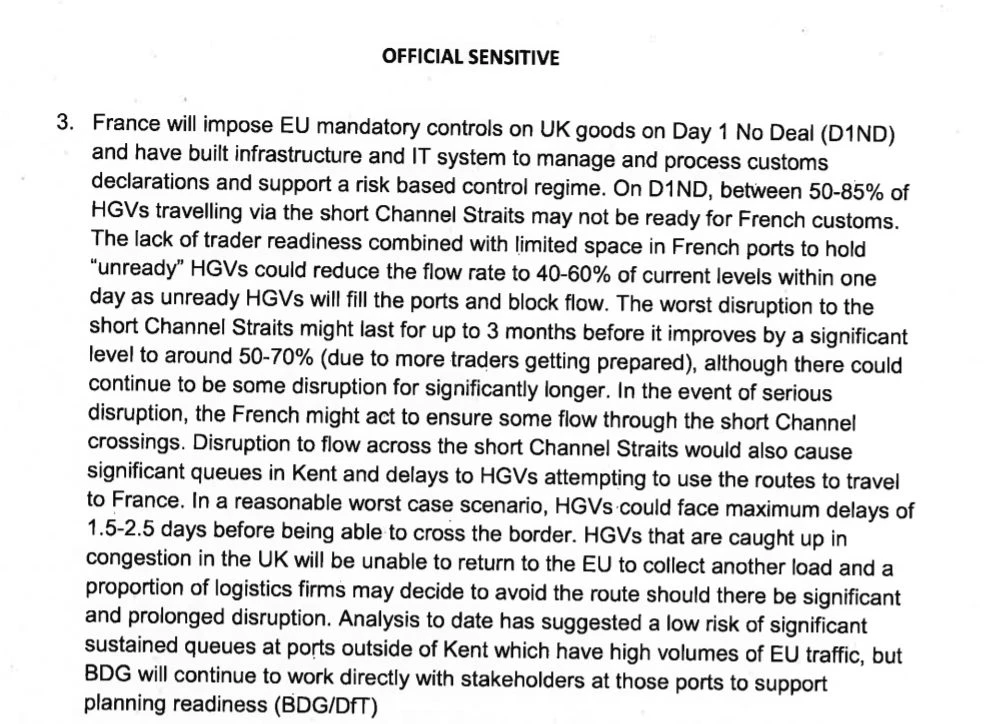

With regard to the key aspects of trade declarations impacted by a Hard Brexit, there is reference for the details on HMRC 's website, a White paper on Operation Yellow Hammer and SAP notes and text.

As per a section on the Whitepaper of “Operation Yellowhammer”, it is clear that in case of a Hard Brexit, the impact of custom and trade will be felt from day 1 and UK trade with EU will be third country/WTO based.

If no agreement is reached ("no-deal scenario"), customs formalities must be observed after the key date (Hard Brexit date) that do not currently apply for trade with the UK while it is an EU Member State. Even if there were to be a free trade agreement between the EU and UK, customs declarations would have to be made for all goods deliveries from or into the EU.

Key points to consider:

- Single Authorisations: The withdrawal of the UK from the EU will affect all single authorisations in the UK. Customs declarations in the UK can no longer be declared with reference to a single authorisation. In addition, it will no longer be possible to manage inventories under one customs ID for customs procedures with economic impact (ECPID) in the UK and the rest of the EU together. Relevant authorisations and inventory-managed procedures must be checked.

- NCTS: In preparation for withdrawal from the EU, the UK has already declared its intention to remain in the Common Transit Convention (CTC), and will therefore continue to use the NCTS procedure.

- EMCS: In the case of a no-deal scenario, the UK will leave the EMCS. Within the UK, excise duty declarations will continue to be made in an EMCS system, but it will no longer be possible to carry out cross-border EMCS transactions.

- EORI numbers: The UK will continue to use the EORI numbers.

- Customs offices: Customs offices in the UK will no longer be eligible for use as offices of exit for exports from the EU as well as for use for EU EMCS transactions. On the reverse side of the coin, customs offices in the EU will no longer be eligible for use as offices of exit for exports from the United Kingdom (UK). Customs offices in the EU will no longer be eligible for use for EMCS transactions in the United Kingdom.

Moving to the next point, regarding changes in the solution used for managing customs declaration, clients can have a variety of solutions including SAP GTS - Global Trade Services (we will keep the scope limited to SAP solutions). In case you have other solutions for custom declaration, please check with the respective solution providers.

For clients based out of the UK and using SAP GTS, SAP has released a host of notes. The key SAP notes are “2764344 - SAP GTS: Withdrawal of the UK from the EU (Brexit) - recommended actions for a no-deal scenario” and “2764912 - GB CHIEF: Changes for a no-deal Brexit scenario”.

Finally, as a UK based organisation which has trades with the EU, some other key aspects to consider are:

- Finding a data provider for all the custom, tariff values etc. After Brexit, the UK will have its own set of customs & tariff information and each trade relation will need to be checked. A good data provider can help ease this process for business.

- Evaluation of trade routes and identifying the impact on the trade flow.

What other areas should we look into as a business?

Each business is different and can have different areas to consider. A key tool might be to use the HMRC page for Brexit preparation, however, there are some aspects which might be more common than others, for example:

Handling of intermediate documents: In a perfect world, all transactions and documents would be complete on the Hard Brexit date and businesses could then start with a “Greenfield” approach after that. This is unlikely to be the case, each business should therefore evaluate the key items which remain open. These could be:

- Sales Rebates - this is a complex case as businesses might have to perform an interim rebate calculation (pre and post Brexit) to handle the respective tax and other legal aspects.

- Contracts and long-term service agreements - Each would need to be reviewed and analysed for impact.

- Triangulation deals / drop ship open order.

- Open purchase order and cases of subsequent credit notes etc...

Summary

As discussed in the above cases, Brexit will have a huge impact and each business should evaluate their own preparation for dealing with a Hard Brexit. There are a lot of scenarios to consider and the impact has both legal and financial impacts.

There are some keys tools / capabilities which businesses should explore and have in place to handle the changes which might come, for example:

- HMRC preparation for Brexit and government issued whitepapers - there is a lot of literature and details available for checking the key points for Hard Brexit preparation. HMRC even provides an industry specific response of key items (with a checklist).

- Exploring SAP notes and references - SAP has provided a lot of notes and reference material which are useful for any business preparing for Brexit.

- Building solution team capabilities – a key aspect of dealing with the change will involve Clients having a strong, almost consulting focussed, inhouse solution team. Business & IT leaders should look at various models to ensure these key capabilities are present.

References

- SAP Notes - A simple search on the SAP market place should bring about a lot of SAP notes relevant for Brexit. You may also find a summary list on the useful blog post (Note: the list of SAP notes keeps changing as per the political changes)

- Government whitepapers: Operation Yellowhammer - HMG Reasonable Worst Case Planning Assumptions, Policy paper: The future relationship between the United Kingdom and the European Union

Stay tuned to Eursap's SAP Blog over the coming weeks, where we will be covering further SAP-Brexit considerations in detail.

Author: Rishab Bucha - SAP Solution Architect - Finance and Procurement