Using SAP to Improve Debt Collection

Using SAP to Improve Debt Collection.

In today’s economic and social situation, companies across the world can find themselves wrestling with their accounts receivables. It seems that previous recessions may turn out to be mild in comparison to the present situation and if companies enforce their rules stringently, it can have a detrimental effect on relations with their customers. Getting your invoices paid can prove difficult and requires a different approach from that which has served well in the past. The Accounts Receivables team needs helpful and intuitive technology solutions that offer new approaches and strategies to understand and remove barriers to getting paid.

With this in mind, companies are turning to SAP to optimise their financial supply chain to improve receivables in the face of rising DSO’s and difficulty in projecting cash flows. The answer lies in analysing your existing receivables management policies to redefine them and optimise debt collection.

No need to wrestle with your AR - Just tame them using S/4HANA

To make debt collection easier and increase cash inflows, companies should plan to automate their debt collection and dispute management processes.

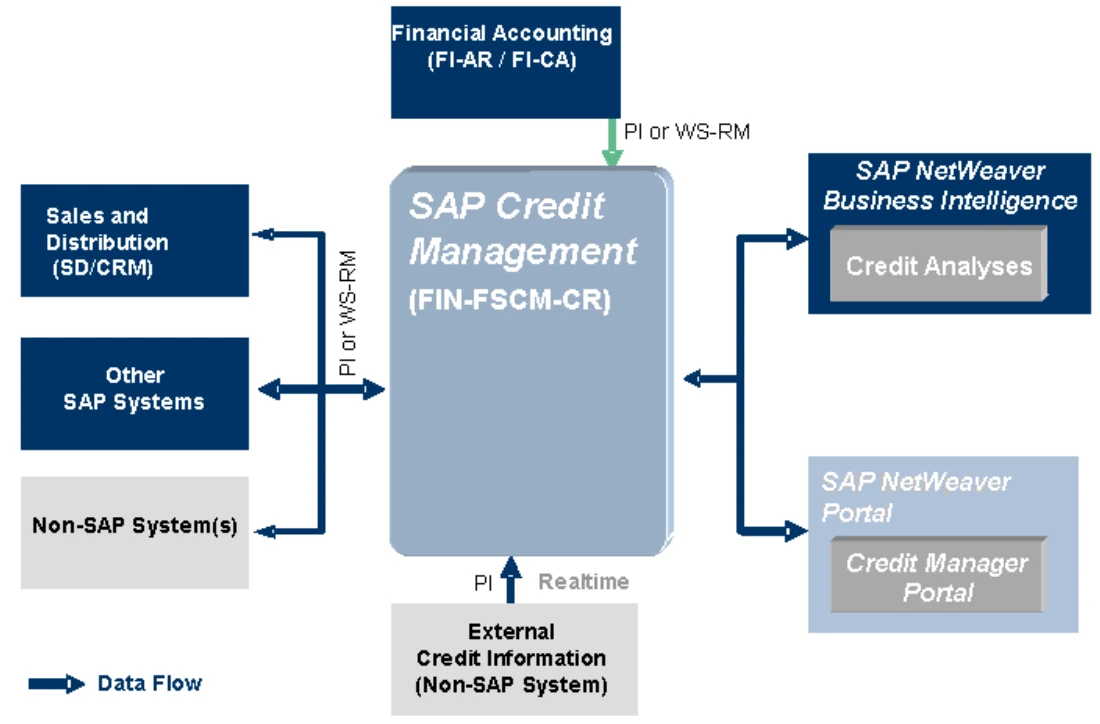

SAP S/4HANA Accounts Receivables module closely works with Credit Management, Biller Direct, and Dispute Management and Collections Management modules that helps customers in designing and executing a sound receivables policy.

During sales order creation, a customer’s creditworthiness will be checked online using SAP S/4HANA Credit Management functionality. At this point, it is worth noting that the S/4HANA credit management functionality has been overhauled since the days of ERP 6.0. The old solution embedded in the Sales and Distribution area of ERP6.0 is no longer available in S/4HANA and has been replaced by Financial Supply Chain Management, which although not new to S/4HANA, is now mandated as the credit management solution.

Depending upon the level of functionality required, this solution can be subject to an additional SAP licence. However, there is still a lot of free out-of-the-box functionality in financial supply chain management which can be taken advantage of.

Good debt collection starts with good credit management

Companies have to redesign and automate their credit and collections policies to realise an immediate increase in cash inflow, due to a higher probability of default in the present situation. As a result, organisations have to reclassify their customers’ risk classes. If possible, credit limit decisions can be automated via a customer’s score, according to a standard formula. When a customer’s score changes, it should suggest a new risk class to that customer dynamically, leading to automatic changes in the customer’s credit status. In this way, a customer’s risk class can control the specification of payment conditions. Credit limits can be finalised based on a score from the customer’s master data settings.

These credit limits have to be maintained centrally in a distributed system landscape and should be the same for the credit segment itself. If necessary, additional check rules have to be defined in addition to credit limits. Examples of this type of check rules could be:

• Maximum transaction value

• Check for maximum number of failed promises to pay

• Age of Oldest Open Item

• Payment Behaviour Index

• Overdue Open Items

The credit management department can maintain credit limits for customers for each credit segment. The credit segment corresponds to one or more credit control areas. When a sales order is created, credit limit utilisation of the customer in the credit segment they belong to will be checked by the system. If sales order value is more than the available credit limit, the sales order should be blocked. If the business receives a credit limit application from the customer, the system can be configured to trigger a credit case workflow to approve or reject – this documented credit decision helps companies to minimise the risk of bad debts.

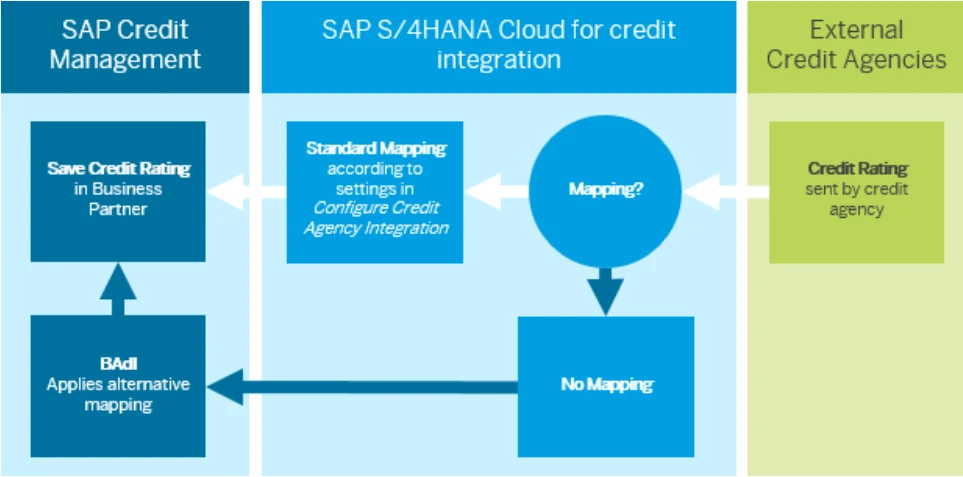

There is an additional option for organisations who need to integrate their system with external credit agencies to get a customer’s credit report. This option is called SAP Cloud for Credit Integration. This service relies upon the previously mentioned additional licence, but comes with the added advantage of out-of-the-box connections with up to 30 credit agencies, such as Dun and Bradstreet. More information can be found in this SAP Help link.

The following flow chart shows the process flow.

Credit agencies also offer organisations a “monitoring service”, which means that if any relevant customer data changes, the agency can send a credit report to the organisation without the organisation having requested it explicitly.

Biller Direct – A good record keeper

One of the most important ways to increase the cash inflows is for the bill-to party and biller to co-operate with each other to solve disputes on an invoice. SAP Biller Direct provides an efficient function for this scenario. Biller Direct is a customer portal, accessed here, where companies can provide their customers the option of displaying their invoices online. Customers can use this function for maintaining their user data, paying and settling their invoices, displaying their invoice documents in HTML or PDF format and making queries or complaints. Biller Direct displays open bills, credits, paid bills and payments. This SAP capability helps business to increase cash inflows.

To avoid delay in payment, the bill approval functionality can be activated in the customer's user data in SAP Biller Direct. During billing, a payment block is then set automatically for documents posted in SAP accounts receivable accounting. This payment block is removed only when the customer has verified and approved the bill in SAP Biller Direct. Customers can also a make a query about their invoices, credit memo, or partial payments. The accounts receivables team resolves this query once they analyse the issue. When customers log a complaint, a dispute case will be registered which can be handled by using SAP dispute management capabilities. This has integration with FI and Biller Direct.

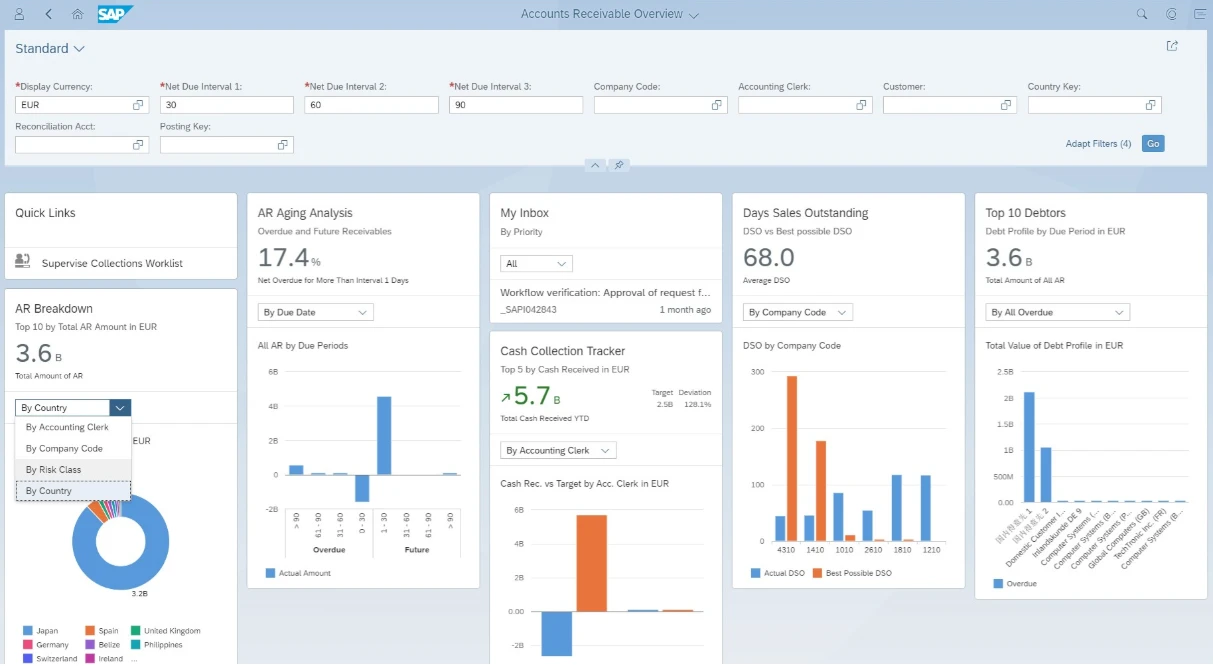

Fiori accounts receivable overview page

The power of S/4HANA can be leveraged in the accounts receivable space by utilising the Accounts Receivable Overview, a new Fiori overview page available from S/4HANA version 1809 onward. This overview page allows users to access quickly all the relevant AR apps in Fiori from a central cockpit. Like standard Fiori apps, filters are available for limiting the data shown, as well as useful navigation between apps.

Conclusion

To ensure you are paid promptly for your services or goods, your accounts receivables team should work closely with the Credit, Disputes and Collections Management teams in an integrated way. A well-designed receivables process increases sales and minimises the risk of bad debts - even in difficult periods. For this, innovative technology and efficient book-keeping helps. Sellers must be aware of collections problems based on the history of customers so they can be avoided before collection problems arise.

Authors: Gayathri Bhanu (CMA Final) and Jon Simmonds (Senior IT Architect)