Migration to SAP Revenue Accounting and Reporting (SAP RAR)

Migration to SAP Revenue Accounting and Reporting (SAP RAR).

Abstract

To recognise revenues either as event or based on time, SAP developed SD Revenue Recognition (SD RR) functionality in 2005. Many SAP Customers have been using the same since then and it has been a stable component.

As soon as the new regulations from IFRS15 came along, SAP introduced the new functionality SAP Revenue Accounting and Reporting (SAP RAR). The purpose of SAP RAR is to handle the new IFRS15 regulations announced on 28 May 2014 with an effective date of 1 January 2018 in countries that adhere to both US GAAP and IFRS. This SAP RAR is available as an add-on and can be implemented in SAP ECC 6.0 with enhancement package 5 or SAP S/4HANA. For integration with SD, we require software component SAP SALES INTEGR SAP RAR 1.0

SAP ECC based SD Revenue Recognition (Application component SD-BIL-RR) will not be available within SAP S/4HANA. Instead of this functionality, the newly available SAP Revenue Accounting and Reporting functionality should be used. This new functionality supports the new revenue accounting standard as outlined in IFRS15 and adapted by local GAAPs. The migration to the new solution is required to comply with IFRS15, even if no Conversion to SAP S/4HANA is performed.

Introduction

IFRS 15 is mandatory for accounting periods beginning on or after 1 January 2018. As Entities leave the old regime behind, lets look at the more prescriptive new standard.

To recognise revenue under IFRS 15, an entity applies the following steps:

• Identify the contracts with a customer

• Identify the performance obligations in the contract

• Determine the transaction price

• Allocate the transaction price to each performance obligation

• Recognise revenue when a performance obligation is satisfied

As SAP ECC- SD Revenue Recognition is not available in SAP S/4HANA, none of the SD Revenue Recognition functionality will work in SAP S/4HANA. For Sales orders or contracts that were processed by SD Revenue Recognition and are not migrated to SAP Revenue Accounting and Reporting, this includes:

• Realise deferred revenue

• Realise revenue before invoice posting

• Defer revenue at invoice posting

• Check SD Revenue Recognition data consistency

• Cancel SD Revenue Recognition postings

All customers using SD based Revenue Recognition and planning to convert to S/4HANA (brown field approach) or implementing S/4HANA in a new system (greenfield approach), must migrate all SD Revenue Recognition relevant sales orders and contracts to SAP RAR prior to the S/4HANA conversion. It is not possible to migrate SD Revenue Recognition to SAP RAR after the Go-live with S/4HANA and we need to set up SAP RAR before we start the migration. This process may be considered a separate project. This may not be mixed with the S/4HANA Conversion project. This helps to clearly plan the project with enough time and resources so that migration is finished before the S/4HANA project kickoff.

Prior to the Conversion to SAP S/4HANA, we need to migrate all sales order and contracts processed by SD Revenue Recognition to SAP Revenue Accounting and Reporting that are:

• Not fully delivered and invoiced

• Have deferred revenue still to be realised and for which you expect follow-on activities like increase quantity, create credit memo or cancel invoice

The purpose of this article is to provide an overview on processes and steps that will be executed during the migration

How to do Basic Prechecks during Conversion of system for SAP SD-RR?

If SD based Revenue Recognition is in use, you need to evaluate whether a migration to SAP Revenue Accounting and Reporting is possible for your business before you decide to convert to SAP S/4HANA.

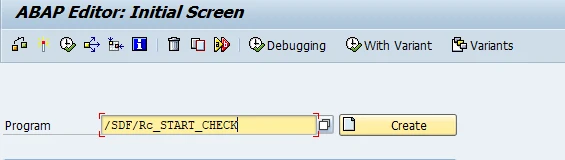

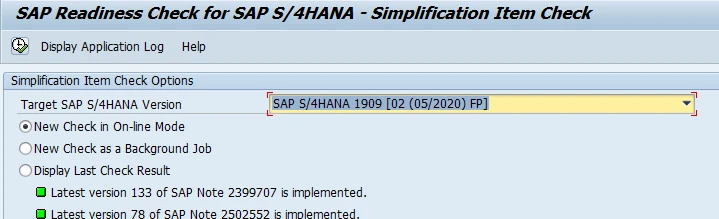

In the preparation phase of the S/4HANA conversion project, the Simplification item check report can be used to identify those simplification items that are relevant for the customer and to determine the steps to be performed in the system to start and maintain consistent conversion. We have to refer SAP note 2227824 for Conversion pre-checks related to RR.

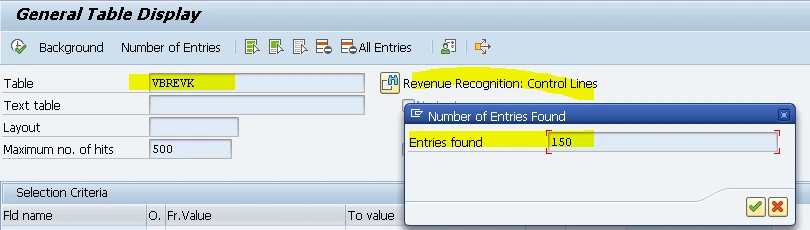

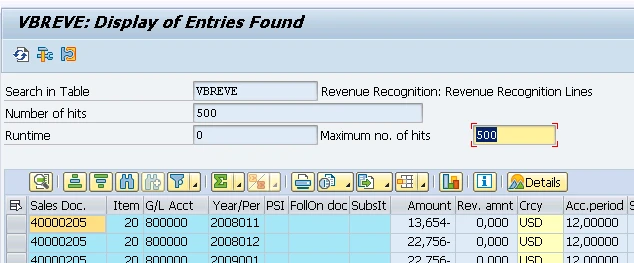

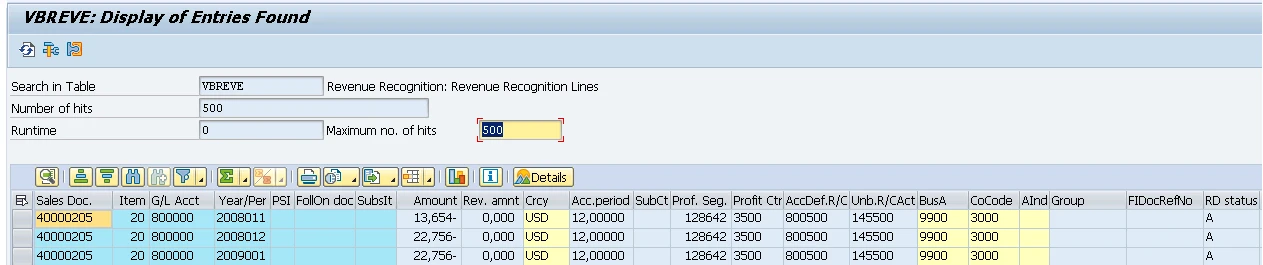

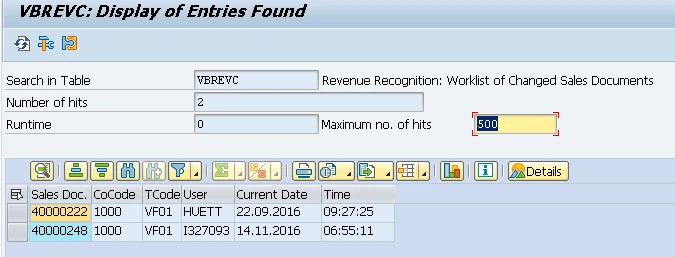

Additionally, you can verify if SD RR has been in use by examining the table entries VBREVK. If no entries exist, conversion can proceed.

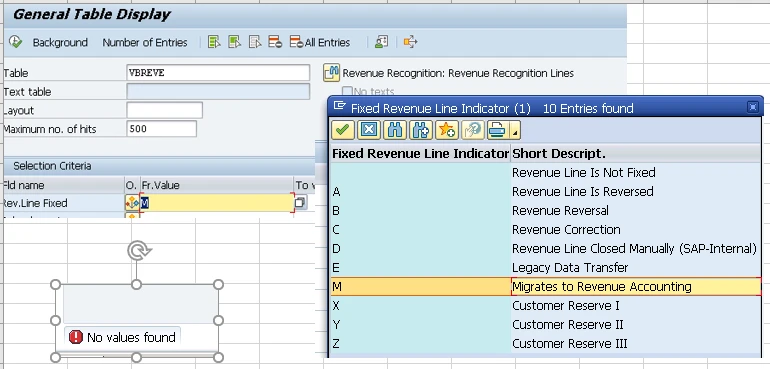

If yes, checks if entries in table VBREVE with VBREVE-REVFIX = ‘M’ exist, meaning that the sales documents are already migrated.

If no entries exist, it is assumed that there are SD RR relevant sales documents to be migrated and therefore the S/4HANA conversion is blocked.

If entries exist with above combination, it means that migration has been partially or might be fully performed. In this case, a check occurs to determine whether there are remaining open sales documents that are still SD RR relevant.

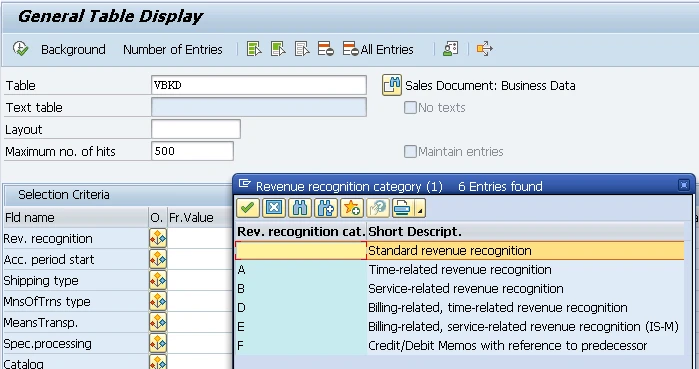

Table VBKD:

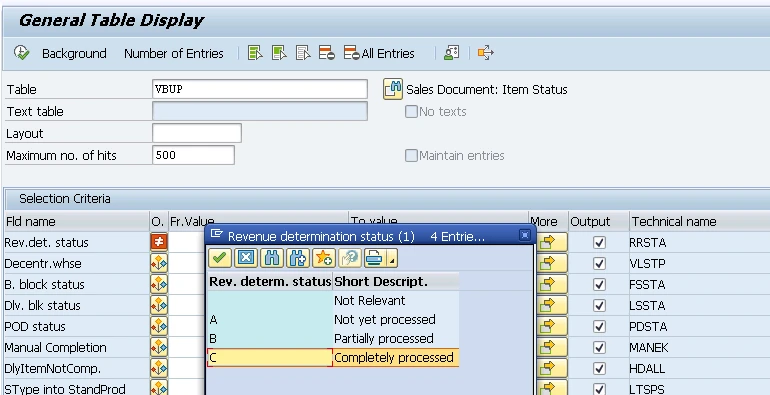

Technically, the check sees whether there are entries in VBKD with VBKD-RRREL that are not blank and that corresponding entries in table VBUP with VBUP-RRSTA are not equal to ‘C’. If the check is positive, the S/4HANA conversion is blocked.

If there are open SD documents that need not be migrated, there is an option for the Simplification item check to skip the above described checks in order to avoid blocking S/4HANA conversion process

If customer is in ECC 6 and EHP lower than 5?

The system must first be upgraded to a release higher than or equal to 6.05. RAR can then be implemented, and migration from SD RR will then be performed. Then SAP S/4HANA made possible.

Also Please verify below points to identify challenges or out of scope of this activity. Below are a few examples of out of scope. Refer Guide / SAP Help for full list

• Pleases verify with customer if any customer-specific events were implemented in SD RR, the related sales documents cannot be migrated adequately.

• IS-Media specific processes (revenue recognition category M) cannot be migrated at all.

• Refer below SAP Notes 508305, 940784 and 940997

During the operational load it is necessary to select the FI documents for all VBREVE lines that were already posted. This selection only works for documents that use the new reference logic. Hence, SD documents created before the change cannot be migrated.

• Also Refer SAP Note 2591055.

What is the pre-requisite for migration?

Consistency Check of SD Revenue Recognition Data is the pre-requisite. This is to ensure all source data is correct and consistent before we transfer to the new capability by the migration process.

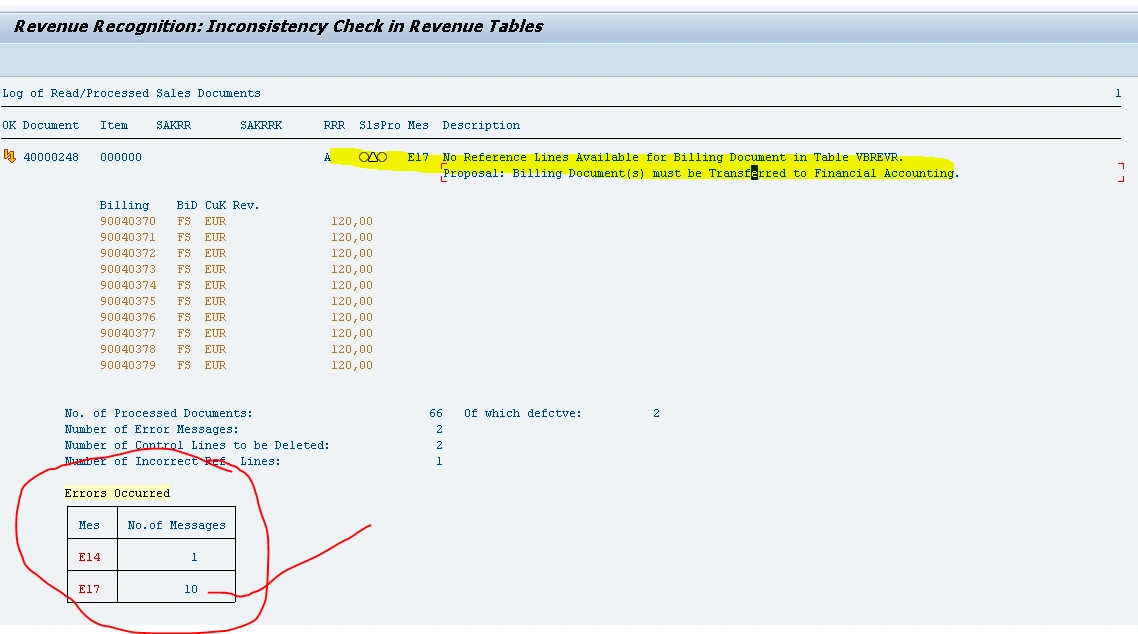

Transaction Code VF47 will help to verify inconsistency in Revenue Tables. VF47 is a tool that enables us to identify many different inconsistency types within SD RR data.

Not all potential error codes have an impact on migration to SAP RAR.

See the above example E17 error code has impact. If there are revenue lines in table VBREVE with status ‘C’ but no content in the field VBREVE-SAMMG, an error is raised too. This scenario may occur in the past when customers tried to fix documents with an E16 error on their own by using the update feature of transaction VF47

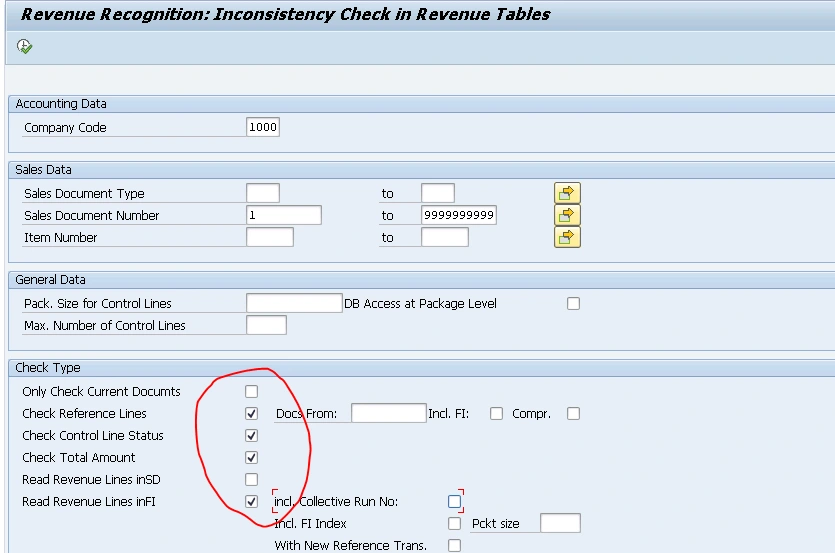

During operational load, VF47 is called for every sales document item with the following parameters first:

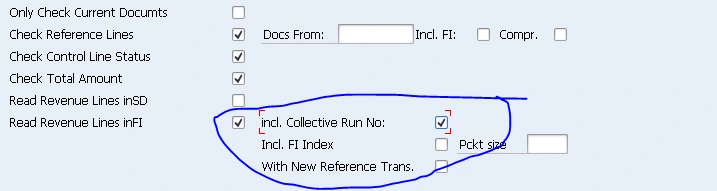

A second check is performed using the Read Revenue Lines in FI flag instead of Read Revenue Lines in SD.

Attention Please: The Read Revenue Lines in FI option does not provide reliable results if FI summarization is active for postings from SD RR

The same restriction applies if the relevant FI documents from SD RR have already been archived.

If error patterns are detected, either via the operational load or using VF47 in advance, open OSS messages with SAP.

Don’t use the update functionality of VF47 to fix certain inconsistencies, unless it is approved by an SAP RR expert. Please refer below SAP Note:

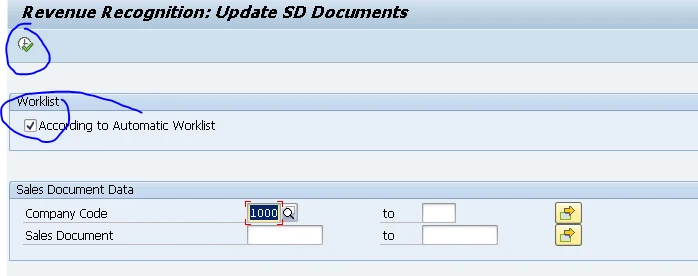

Update Sales documents with VF42

Before we perform migration, we should make sure that all revenue lines in the table VBREVE have their final values.

This can be achieved by running the transaction VF42.

This need not be executed if the sales documents are updated in real-time in SD RR

In this case, there must be no entries in the table VBREVC.

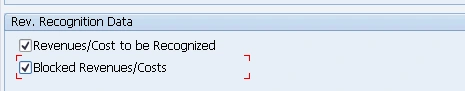

All sales documents, for which entries in VBREVC exist, are not picked up by the operational load. Use transaction VF44 (Revenue Recognition: Post Revenue) to recognise all open revenue lines

Select below options and execute

This is to recognize all revenues up to the transfer date.

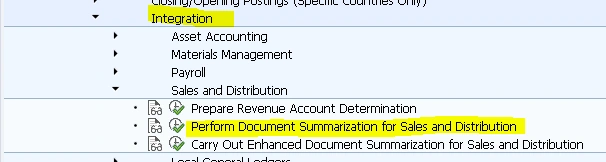

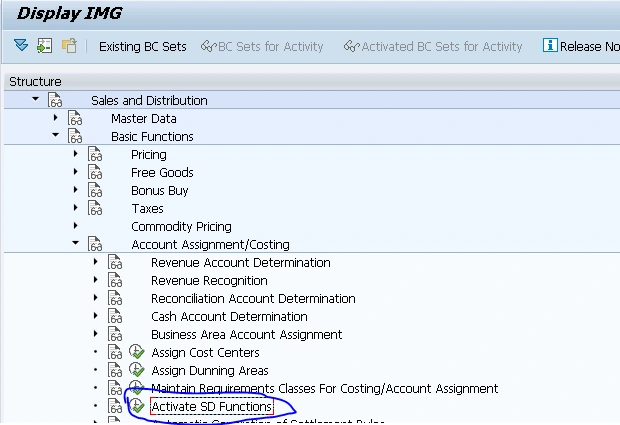

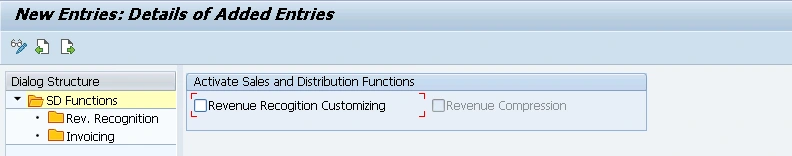

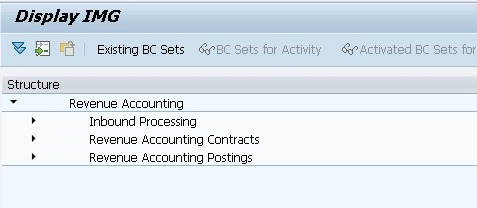

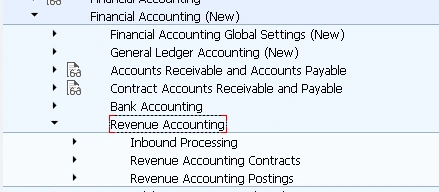

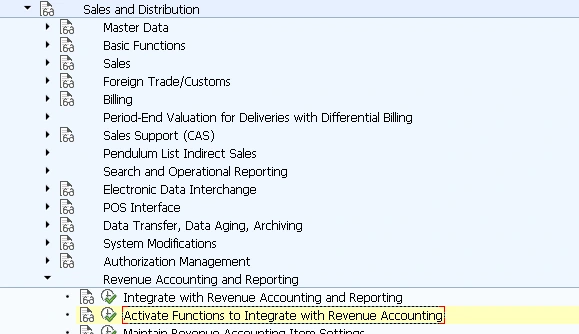

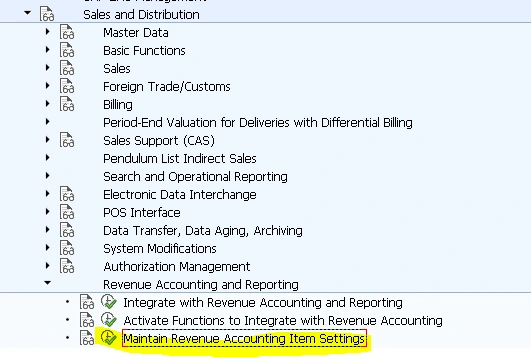

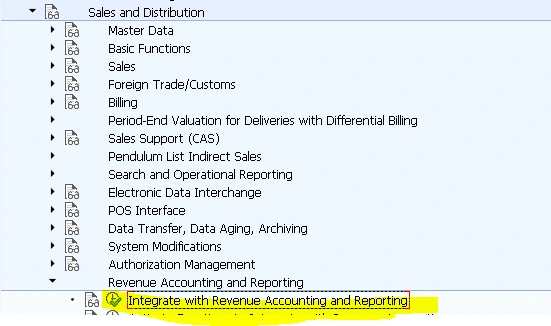

Setup of SAP Revenue Accounting & Reporting: Configuration:

1. First, revenue accounting and reporting processes must all be set up for SD-RR migration

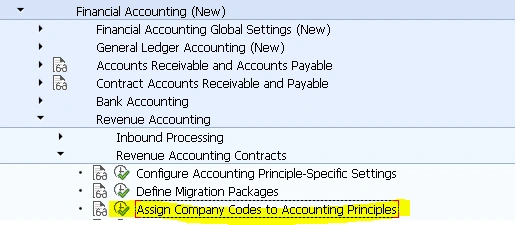

The configuration IMG can be found under: FARR_IMG

Or follow the menu path below:

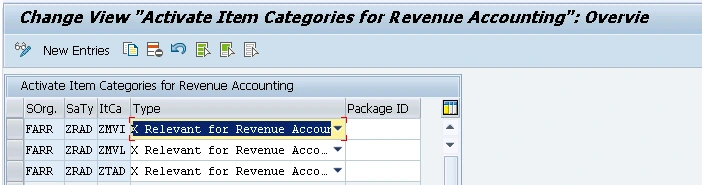

• Activation of the required Revenue Accounting Item classes and generation of the interfaces

• Setup the accounting principles and maintain the company code related settings

• Creation of contract categories and POB (Performance Obligation) types, including the related number ranges

• Maintenance of the BRF+ application for the SAP RAR processes

• Create the accounts, then setup account determination for RAR-specific P&L and balance sheet accounts

2. Use of migration packages is not mandatory for SD RR migration.

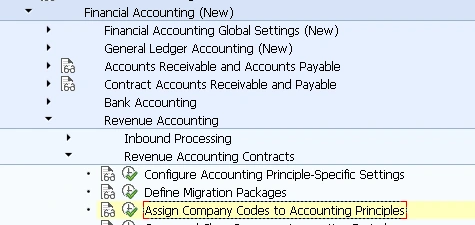

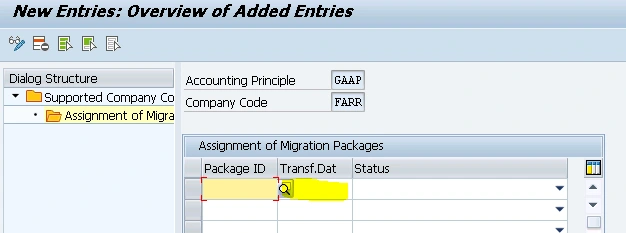

3. Transfer Date

Transfer date will be maintained in below path:

• Assign Company Codes to Accounting Principles

• Maintain a transfer date on the second level

• The transfer date must always be the last day of a period

The operational load only selects the posted revenue lines that are assigned to periods lower than or equal to the period of the transfer date.

4. Special SD processes: Proof of delivery (PoD) or incoming invoice are used, the corresponding entries must be maintained in IMG:

5. Activation of Inflight Checks:

Inflight checks were introduced to detect inconsistencies as early as possible before any contracts or POBs are stored in the database.

Please make sure that the checks provided by BAdI FARR_EXTENDED_CHECK are not de-activated or manipulated. Refer SAP Notes 2476987 and 2567106.

What are the Migration tools?

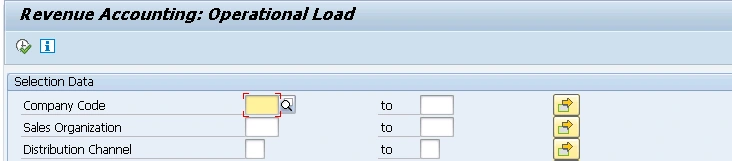

1. The main tool that is used to migrate SD RR data to SAP RAR is the operational load program. Transaction FARRIC_OL

a. General Functionality

• Operational Load is used to start the migration process

• This program creates fulfillment RAIs and invoice RAIs based on the selected sales documents order Items

• It refers to the already recognised revenues

• As soon as the SD data is transformed into RAIs and legacy data, the revenue recognition category is removed from the sales document item and all revenue lines are set to Inactive

b. Prerequisites

The operational load only works as expected based on configuration

Integration Component for Revenue Accounting is activated

The affected company code is customised for initial load, meaning that the status Migration must be assigned to the relevant company codes

c. Selection

Based on the entered selection parameters, the root documents are selected. The root document is the document that is found on the highest level of the document flow.

For SD RR-relevant sales documents, the item status in table VBUP is checked. If the revenue determination status (VBUP-RRSTA) is C, it skips.

Only if the document date is older than or equal to the migration transfer date, the documents are selected by the operational load.

d. Processing Parameters

There is a unique ID to identify the run. This ID is generated automatically.

Refer Transaction SLG1 for logs

e. Processing Type

Apart from the type Load that creates the RAIs and the legacy data, the program can also be executed using the Reset type. Reset means that the Revenue Accounting relevance is removed from the corresponding item and the revenue lines in the table VBREVE are activated again. Therefore, the program recovers the state in SD that existed before the last operational load, but only if the same selection criteria is applied.

f. Expert Mode

If the selected options of the transaction FARRIC_OL are not sufficient, the extended version can be used with transaction FARRIC_OL_EXPERT.

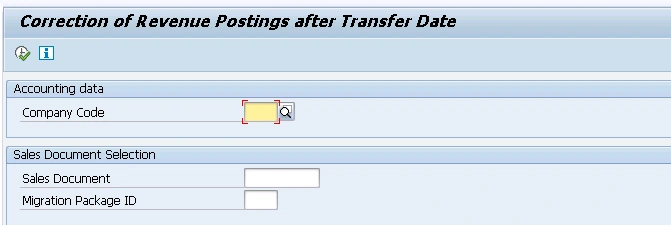

2. Revenue Correction Report

This report is necessary if in SD RR, between the transfer date and the date of the operational load, VF44 postings and/or SD RR relevant billing documents were created.

You can use either the transaction FARRIC_RR_CORR

Execute the revenue correction report as the last step of migration once the RAI consistency in inbound processing has already been verified.

Refer SAP OSS Note 2715378

3. Revenue Accounting Data Validation

To ensure quality and consistency for SAP RAR contracts and POBs created by the migration process, the transactions FARR_CONTR_CHECK and FARR_CONTR_MON can be used.

Conclusions

The settings for SAP RAR must be maintained before migration starts. It is recommended that your system should be on the latest support package/feature package level in order not to miss out on the most important OSS notes respectively and to avoid additional effort during implementation of the OSS notes. Refer to the latest SAP help or OSS notes when starting this project.

About the Author: Dr. Ravi Surya Subrahmanyam is a technical and Financials writer with a background in SAP Financial Accounting, Funds Management, Group Reporting, Financial Supply Chain Management, Cash Management & in-house cash, SAP S/4 HANA Finance. He has been working as a Director for the SAP Practice for The Hackett group India Ltd, (Answerthink Company). He completed his Masters degree in Finance from Central University, Master of Commerce from Osmania University, Master of Commerce from Andhra University, and Ph.D.in Finance from one of the best universities in India. His research Papers have been published in National and International magazines. He has been a Visiting Instructor for SAP India Education and SAP Indonesia – Education. He has been working on Conversion and Upgradation projects. He is a Certified Solution Architect for SAP S/4 HANA and an SAP S/4 HANA Certified Professional. He can be reached at sravi@answerthink.com or fico_rss@yahoo.com