SAP S/4HANA Conversion & Subsequent Optimisation for an SAP S/4HANA System

SAP S/4HANA Conversion & Subsequent Optimisation for an SAP S/4HANA System.

Abstract:

For SAP Customers with ERP 6.0 on lower EhP levels than 8, it isn't necessary to move to EhP 8 in a separate project before they convert to SAP S/4HANA. A one-step conversion is also possible. If customers currently run a system on classic G/L and want to upgrade to use the functionality of the latest version of SAP S/4HANA, they can convert directly from the classic GL to S/4HANA and optimise later.

Introduction:

If the existing organisational structures need improving, a Greenfield approach may be the better solution. If the existing system is in relatively good condition, a Brownfield approach is likely to be the preferred path. As of now, there is no SAP service for a subsequent switch from an accounts approach to a ledger approach. However, it might have been in the plan. Currently, the only way to convert from the accounts approach in the classic GL to the ledger approach in S/4HANA in a SAP standard conversion is to migrate to the new general ledger as a separate project before converting to S/4HANA ( Migration to New General Ledger Accounting). In all other cases, a system can be converted directly from the classic GL to S/4HANA and optimised later.

Conversion path options for Class GL customers:

- SAP ECC 6. Classic GL, Account Approach to SAP S/4HANA Account Approach

- SAP ECC 6. Classic GL, Account Approach to New GL in ECC by new GL migration project and then SAP S/4HANA Conversion

Please verify the below two options with SAP. So SAP Can provide the correct information

- SAP ECC 6. Classic GL, Account Approach to SAP S/4HANA Account Approach > then to SAP S/4HANA Ledger Approach

- SAP ECC 6. Classic GL, Account Approach to SAP S/4HANA Ledger Approach

Below are the some of the Constraints if customers are moving from Classic General Ledger to SAP S/4HANA.

- Implementation of document splitting in the same fiscal year

- Balance sheets at the profit centre level for the same fiscal year

- Migration from special purpose ledger to new general ledger accounting

- New implementation of parallel accounting in same fiscal year

- New implementation of segment reporting in same fiscal year

- Implementation of the ledger approach for parallel accounting in the same downtime

- Transfer of quantities to new general ledger accounting

When converting the system from classic G/L, the classic GL data will be automatically transferred to the new data structures as SAP S/4HANA is based on New GL Functionality. Existing EC-PCA remains the same after conversion. If the Customer has already started a new GL migration to continue this project they can complete this and then convert the system. Customers with Class GL need not necessarily migrate to new GL before converting the system unless they want to use the ledger approach immediately after conversion.

Implementation of further Accounting Principle: Customers who have ledger approach, can introduce new accounting principle after Conversion

Multinational Companies may be required to produce financial statements depending on different accounting principles and practices including IFRS, US GAAP, or local legal requirements. Customers who have a ledger approach can introduce new accounting principle and additional ledger.

Business Case Example:

The Customer is using a ledger approach. The fiscal year K4 is in your system. Customer Converted to SAP S/4HANA in October 2020 (period 10). The customer cannot implement a new accounting principle in fiscal year 2020. At the earliest, they can do this in fiscal year 2021.

When we define a new ledger to report a new account principle, we have to ensure the new ledger is updated with an Opening balance. Open items and transactions that are already posted for that financial year. We have to do a related configuration such as new depreciation areas, etc perfectly.

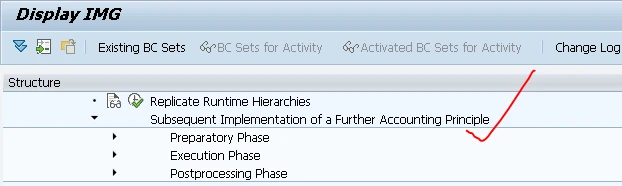

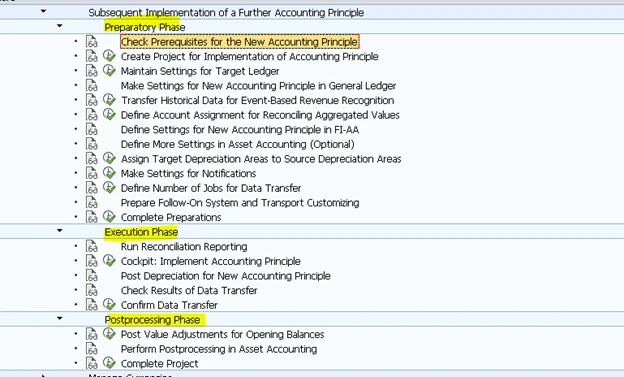

SPRO> Financial Accounting > Financial Accounting Global Settings > Tools > Subsequent Implementation of a Further Accounting Principle.

Limitations:

- If you are already using the ledger approach, the new accounting principle can only be implemented for those company codes that are using the ledger approach. If you have the accounts approach, a new accounting principle cannot be implemented. Contact SAP for this.

- A change from the accounts approach to the ledger approach is not supported in this scenario. Please contact SAP for this.

- It is not possible to implement an additional ledger in the same Financial year you converted to SAP S/4HANA Finance.

- It is not possible to assign a newly created additional ledger to an existing ledger group.

- Fiscal year variant of existing ledger and new ledger must be same.

- Must have the same set of currencies and currency types for both existing and new ledger.

- We cannot define an extension ledger in the same project.

- If the same chart of depreciation is assigned to multiple company codes, the new accounting principle must be configured for all company codes that belong to a chart of depreciation.

What is out of scope in this project?

- Replacement of accounts approach by Ledger approach

- Data Transfer from Special Ledger to newly created ledger

- Defining multiple additional ledgers in one project

- S/4HANA Conversion and Implementation of additional ledgers in same downtime

The activation date of the new ledger is the first date of the new fiscal year before posting any transaction in the system. The data transfer to new ledger needs downtime and customers need to plan for this. Value adjustments will happen after downtime.

The sequence is:

- Configuration (uptime)

- Data Transfer to new ledger in downtime

- Value Adjustments after downtime

This project is guided by a pre-defined and controlled sequence of steps in the SPRO. Please see below screen:

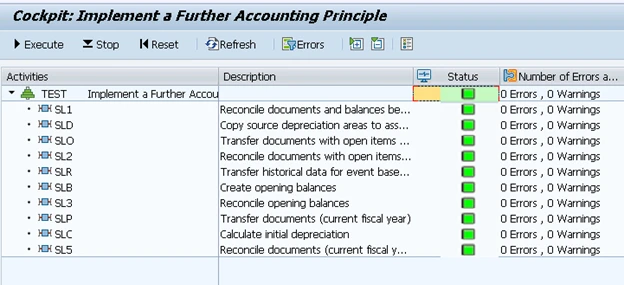

- Cockpit: Implement Accounting Principle must execute without any errors. You can control the progress of the activities and errors if you click Refresh.

- When you right-click the mouse on the message column of the individual package, you can navigate to the log display. You can see detailed information about all messages.

The cockpit handles all mass data activities related to the implementation of the new ledger. In the cockpit the following reconciliation and data transfer steps will be carried out:

- Step: SL1 - The system checks if the accounting documents, relevant for the data transfer, are consistent.

- Step: SLO - All items, which are open at the activation date of the new ledger, are transferred into the target ledger.

- Step: SLD - The system enhances the asset accounting master data with the depreciation areas for the new accounting principle.

- Step: SL2 - The open items that were transferred into the target ledger are reconciled with the open items in the source ledger taking the activation date of the target ledger into account.

- Step: SLR - If you use event-based revenue recognition and historical revenue recognition, results are relevant for the new accounting principle and this data is transferred into the target ledger.

- Step: SLB - The target ledger is filled with the opening balance for the start of the current fiscal year.

- Step: SL3 -The opening balances of source and target ledgers are compared.

- Step: SLP - All accounting documents of the current fiscal year are transferred form the source ledger into the target ledger. This also includes ledger-specific documents from the source ledger.

- Step: SLC - Calculate initial depreciation.

- Step: SL5 - Reconcile documents (current fiscal year) - all documents in the target leger are checked and compared with the documents in the source ledger.

Post Value Adjustments for Opening Balances

Expect to encounter frequent situations in which you will have to manually perform subsequent postings. This is necessary to correct the opening balance sheet after transferring the balance carry-forward from another ledger.

Using Transaction FBCB we can make postings to the balance carry-forward of the current fiscal year Period 0

When using this function, consider the following:

You can only make postings to accounts that are not managed on an open item basis. You can’t make postings to reconciliation accounts (customers or vendors or fixed assets).

Dependencies:

If FBCB documents exist, you can no longer reset the data transfer. If it is essential to reset the data transfer, you need to reverse all FBCB documents first

Perform Postprocessing in Asset Accounting

Perform post processing for Asset Accounting. This is especially adjustment postings for the new accounting principle.

Complete Project

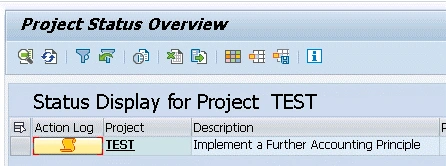

Confirm that the overall project, including all relevant data transfer and reconciliation activities - as well as adjustment postings for the new accounting standard - have been completed.

After setting a project to completed, you cannot reset or run the data transfer and you are no longer allowed to adjust the balance carry-forward values in the new ledger.

To reset project, authorisation object FINS_MPROJ should be assigned to your user ID.

About the Author:

Dr. Ravi Surya Subrahmanyam is a technical and Financials writer with a background in SAP Financial Accounting, Funds Management, Group Reporting, Financial Supply Chain Management, Cash Management & in-house cash, SAP S/4 HANA Finance. He has been working as a Director for the SAP Practice for The Hackett group India Ltd, (Answerthink Company). He completed his Master’s degree in Finance from Central University, Master of Commerce from Osmania University, Master of Commerce from Andhra University, and Ph.D.in Finance from one of the best universities in India. His research Papers have been published in National and International magazines. He has been a Visiting Instructor for SAP India Education and SAP Indonesia – Education. He has been working on Conversion and Upgradation projects. He is a Certified Solution Architect for SAP S/4 HANA and an SAP S/4 HANA Certified Professional. He can be reached at sravi@answerthink.com or fico_rss@yahoo.com