Account Postings in SAP MM Purchase-to-Pay

Account Postings in SAP MM Purchase-to-Pay.

This article will review high-level account postings for following major documents of the SAP Materials Management Purchase to Pay process flow:

- Purchase Order

- Goods Receipt Document

- Invoice Verification (Initial Entry)

- Release Blocked Invoice Verification Entry

- Accounts Payable

I will be using very simple T account notation with round numbers for illustrative purposes. The underlying example used here is a simple purchase order to buy finished goods (that your company immediately resells via Order to Cash). Accordingly, this analysis does not get into MRP scenarios such as Make-to-Order. Precise GL Account numbers are not used in this article as specific systems may vary in this regard. But the essentials are all here. This article is meant to serve as a useful high-level reference.

1. Purchase Order

Purchase to pay starts here. The Purchase Order document makes the following impact on your company’s financial accounts:

Initial orders of this type do not involve goods movements and/or accounting impacts. Accordingly, the T account entries above for a saved Purchase Order are blank. Purchase Orders may have other impacts on MRP, production planning, and future inventory levels, for example, but not to accounting.

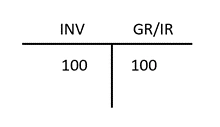

2. Goods Receipt

The second step in Purchase to Pay is to perform the Goods Receipt via MIGO. Here is the impact:

As material goods have now been transferred to stock in your warehouse, your Inventory account is now increased, or debited, by some amount, say $100. This is offset by a corresponding credit of $100 to a temporary account in SAP called Goods Receipt /Invoice Receipt, or simply “GR/IR” for short. Technically, this should be a credit posting to your vendor’s account. But since you don’t have the vendor’s invoice at this point in the process, you will make the credit posting to the GR/IR account for the time being.

3. Invoice Verification (Initial Entry)

Once you have received goods from your vendor, you can be sure that they will always send one more thing: their invoice! You will need to input and save your vendor’s bill to your company’s Invoice Verification Process via MIRO. The following corporate accounts are affected when you save the document, which is typically blocked for payment automatically, as follows:

Creating an Invoice Verification at the initial blocked level makes no impact on your financial accounts. In the past, we used to call this “parking your invoice verification,” which means that the document typically needs to be approved before payment can be processed to your vendor. Please bear in mind that most corporate fraud involves payments to spurious vendors. That is why there is some diligence in this process.

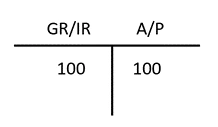

4. Release Blocked Invoice Verification Entry

Once your manager has released the blocked Invoice Verification document, corporate accounts are impacted as follows:

This time we will debit the GR/IR account by $100 while crediting the same amount to the Accounts Payable account. Notice that the debited GR/IR amount of $100 will be cleared or offset against the previous credit posting of the same amount. This is a necessary step in your SAP Financial management. If you do not post corresponding debits to your GR/IR account, a large credit balance will continue to amass. This should be a signal that someone is not paying the vendors (or worse, the vendors are being paid and the books are not correct!)

As a bonus, we will now look at the next step in Purchase to Pay which takes place in the FI module, the Accounts Payable posting.

5. Accounts Payable Document

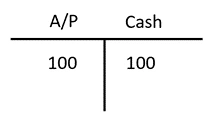

So what happens when your customer gets paid by your Accounts Payable department?

The outbound cash is a credit (decrease) to your cash account. This is matched with a corresponding debit to your open Accounts Payable. This debit to Accounts Payable offsets or clears the open credit seen previously, effectively closing it out.

At a very high level, this is the happy ending to our Purchase to Pay story. You wanted a product that your vendor sells. You placed the order. You wrote them a purchase order. The order was delivered to you and the vendor was kind enough to send you their invoice. Which mercifully helps you reduce your open GR/IR account.

In conclusion, their invoice is entered in your Invoice Verification process, released, and then paid. They will be happy to sell to you again. This is the essence of purchasing goods and paying your vendors in an SAP ECC and S/4HANA format.

For more information on a related topic, Order to Cash – the flip side of Purchase to Pay – please refer to my recent book, “Sales and Distribution with SAP S/4HANA - Business User Guide,” cowritten by one of the UK’s leading SAP SD consultant Jon Simmonds: https://www.sap-press.com/sales-and-distribution-with-sap-s4hana-business-user-guide_5263/

As a special bonus to EURSAP blog readers, please use this code SDEUG15 for a 15% discount!