An Overview on SAP Multi-Bank Connectivity - SWIFT Integration

An Overview on SAP Multi-Bank Connectivity - SWIFT Integration.

Abstract

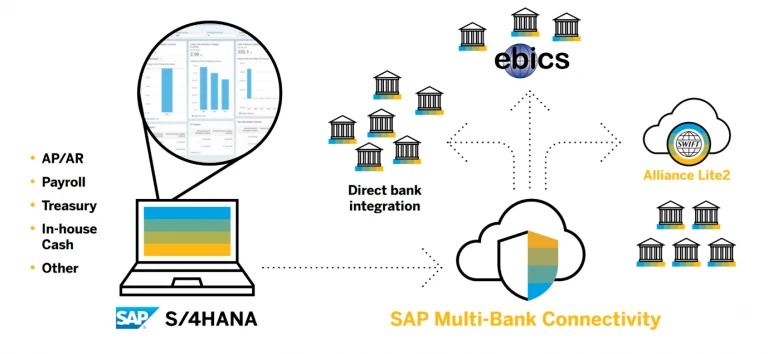

Most companies perform Business Transactions with multiple banks and may have to connect the banks for verifying their payments, acknowledgements, bank statements, etc. SAP Multi Bank Connectivity is a secure network provided by SAP and embedded by SWIFT Connectivity. It is an SAP Business Technology Platform (BTP) solution managed by SAP to provide customers connectivity with their banks. MBC combines the benefits of SAP with seamless integration into the SWIFT network.

SAP Multi-Bank Connectivity is a connectivity solution that enables banks and their corporate customers to exchange messages. To use this solution, we need to use the connector for SAP Multi-Bank Connectivity. One connector can be configured to communicate with multiple banks.

Once F110 (payment run) is completed, payment messages will be sent to the relevant bank automatically via SAP MultiBank Connectivity. In response, the connector receives bank messages through SAP Multi-Bank Connectivity.

Introduction

The SAP Multi-Bank Connectivity connector is an add-on available for releases of SAP ERP 6.0 EHP 0 and higher. Within SAP S/4HANA this add-on is already embedded and can be used once a customer subscribes to SAP Multi-Bank Connectivity.

The SAP Multi-Bank Connectivity connector is integrated with the payment processing functions in SAP ERP. Following a payment run or an approval step within SAP Bank Communication Management, companies can send the payment files automatically to financial service providers through SAP Multi-Bank Connectivity. In return, SAP ERP receives payment status reports and financial service providers' statements through SAP Multi-Bank Connectivity, and then automatically processes them.

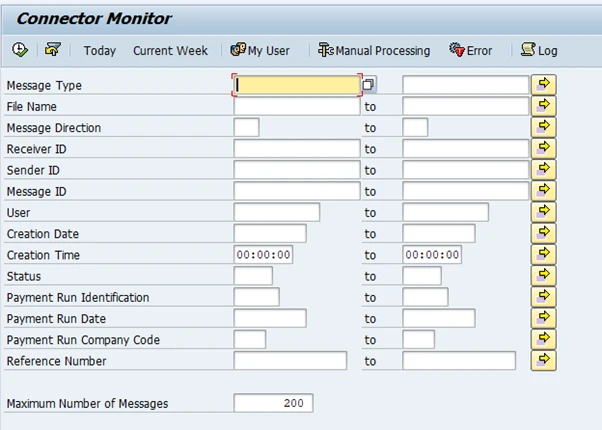

SAP Multi Bank Connectivity (MBC) is a cloud-based solution. It provides companies multi-bank, digital channel between their SAP systems and their banks. To integrate an SAP system and SAP Multi-Bank Connectivity, the connector for SAP Multi-Bank Connectivity is utilised. All messages to and from SAP Multi-Bank Connectivity pass through the connector. Message monitoring is available at the connector for SAP Multi-Bank Connectivity using Transaction code: /N/BSNAGT/MONITOR

Figure: Transaction code : /N/BSNAGT/MONITOR

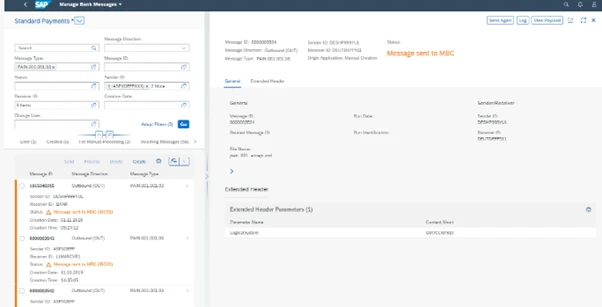

We can also use an app, “Manage Bank Messages.”

Figure: SAP Fiori app Manage Bank Messages

We can see Sender ID, Receiver ID, message type in every message sent through the connector for SAP Multi-Bank Connectivity.

Constraints

• The functionality of the connector is closely integrated with the functionality of SAP Multi-Bank Connectivity. Some of the features of the connector are dependent on the availability of the corresponding features in SAP Multi-Bank Connectivity.

• SAP system must be on ECC system with ECC 6.00 with any EHP, or SAP S/4HANA Cloud or On-Premises systems can connect to SAP MBC.

Features of the connector

• The connector sends outbound messages asynchronously, via a defined Web service interface.

• The connector receives inbound messages asynchronously, via a defined Web service interface.

• Connector can send newly created payment messages automatically after F110 program. Connector can be used to send and receive messages from other business processes.

MBC Connector Configurations

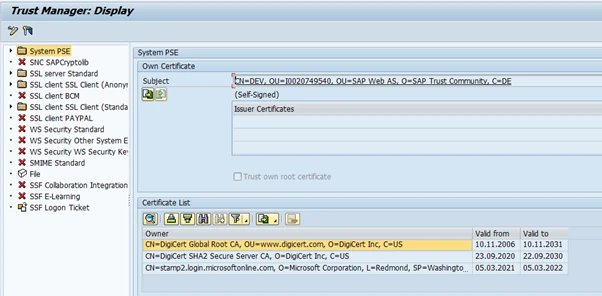

SSF Profile Settings

Transactions STRUST and SSFA to define the SSF profile Settings for the connector for SAP Multi-Bank Connectivity

Transactions STRUST

Number Range for Message ID

Maintain the number range for the message ID to generate a unique message ID when the system is not supplied with a message ID during the creation of messages.

Number range object /BSNAGT/N2.

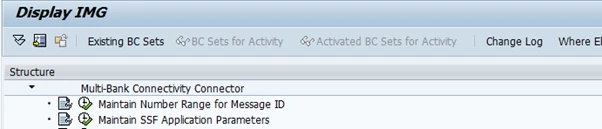

Please use the Customising activity under Multi-Bank Connectivity Connector Maintain Number Range for Message ID to maintain the interval N2 for this number range object.

Figure: Maintain Number Range for Message ID

Variants for Processing Bank Statements

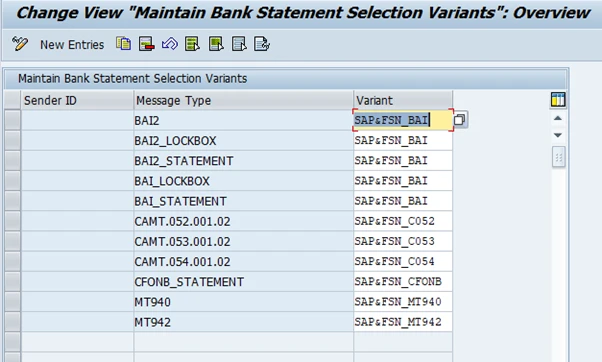

Maintain selection variants for bank statements.

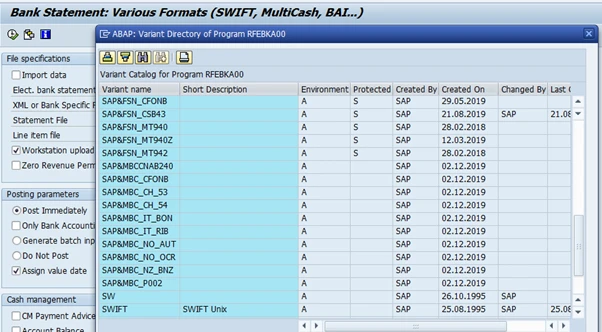

The connector for SAP Multi-Bank Connectivity supports direct processing of several bank statement formats. For the processing of bank statement messages, the payload of the incoming message is handed to transaction FF.5. To use the direct processing of bank statements, we have to specify the FF.5 variant that you want to use for incoming message types.

Figure: Variants at FF.5

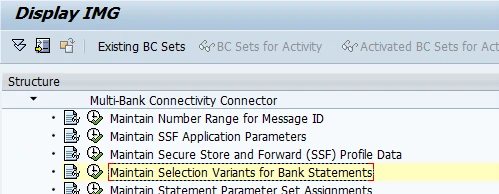

You can specify the variant under Multi-Bank Connectivity Connector Maintain Selection Variants for Bank Statements.

Figure: Maintain Selection Variants for Bank Statements

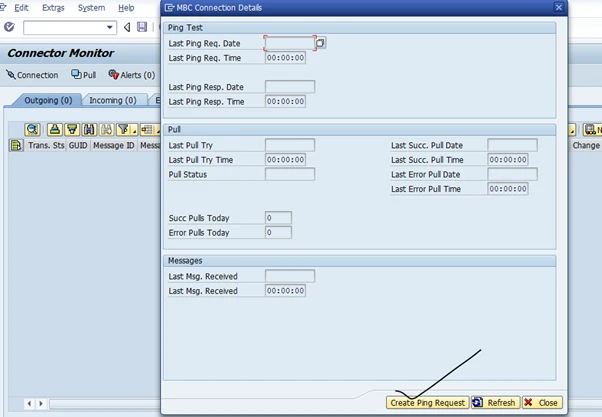

Ping Tests

Create a ping test to test the connectivity between the connector & SAP Multi-Bank Connectivity

1. /n/BSNAGT/MONITOR

2. Execute.

3. Choose Connection and Create Ping Request.

4. A ping request message is created and sent to SAP Multi-Bank Connectivity.

Figure: Create Ping Test Requests

You can specify the variant depending on sender ID and message type of the incoming statement messages. During runtime, the connector for SAP Multi-Bank Connectivity reads this configuration and calls transaction FF.5 as a job using the assigned variant for processing the incoming bank statement message.

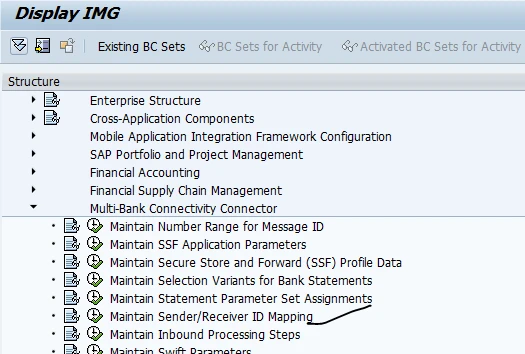

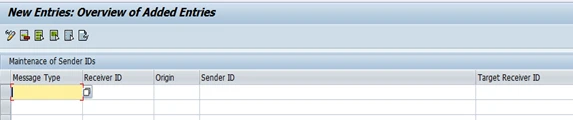

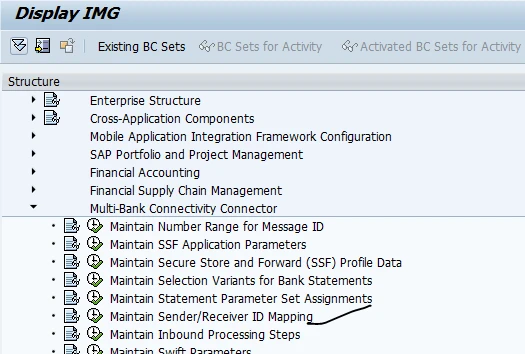

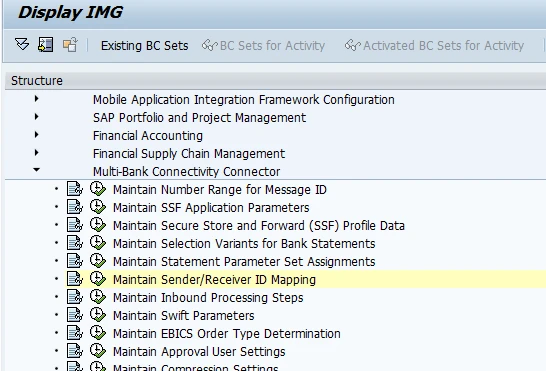

Mapping of Sender/Receiver IDs

Figure: IMG Path for Maintaining Sender and receiver Ids

In this step, we maintain Sender ID for a Message Type and/or Receiver ID. We define different Sender IDs for communicating with different banks. These custom Sender IDs are used by the connector for the SAP Financial Services Network whenever a message is created.

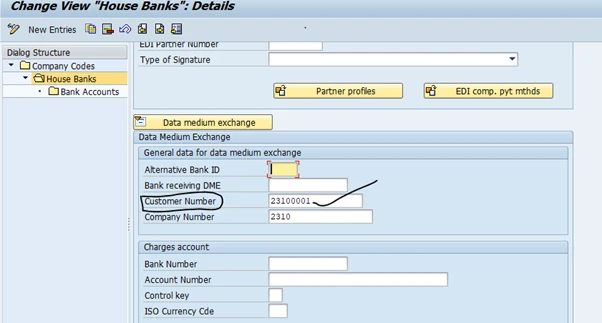

For payment messages created via Payment Medium Workbench, the system uses the Customer Number maintained at House Bank level as the Sender ID, then the corresponding custom Sender ID entries are ignored. However, the system uses the custom Sender ID maintained in this Customising activity as a fall-back, and it is used in the event that the Customer Number has not been maintained at House Bank level.

Sender and receiver ID’s are used for routing messages.

Receiver ID

Receiver id is SWIFT/BIC of receiver bank.

MBC connector → Maintain custom sender/receiver ID.

Figure: FI12 House Bank Master Data

If you leave the Message Type and/or Receiver ID blank. The system treats such entries as relevant for all Message Types and/or Receiver IDs. In the event of multiple valid entries, the system uses the most specific one.

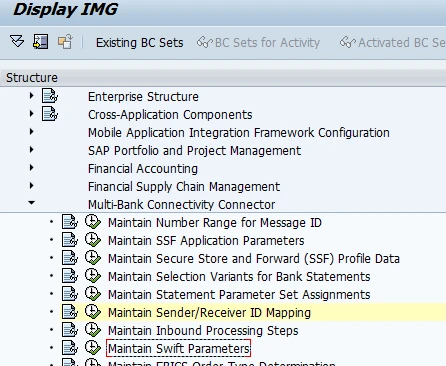

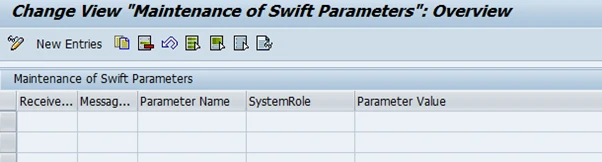

Maintain Swift Parameters:

Figure: IMG path to maintain Swift Parameters

We need to maintain to send messages to banks using the SAP Multi-Bank Connectivity. We define SWIFT parameters depending on receiver ID and message type.

Maintain Approval User Settings

Here we maintain the settings for determination of approval users. Whenever a payment, which has been approved in SAP Bank Communication Management, is sent out, the connector for SAP Multi-Bank Connectivity reads the approval users and sends up to two approval users to SAP Multi-Bank Connectivity along with the outgoing message.

Figure: Maintain Approval User Settings

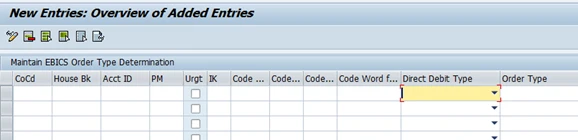

Maintain EBICS Order Type Determination (optional)

In scenarios where SAP Multi-Bank Connectivity connects to banks via EBICS, an EBICS order type needs to be provided.

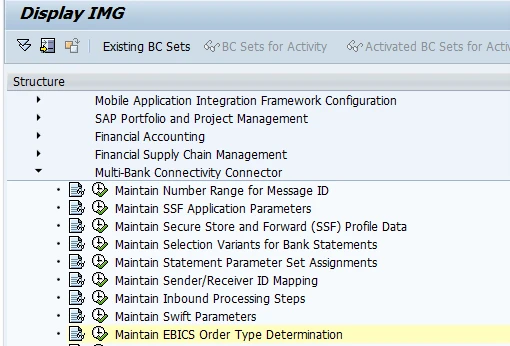

Figure: IMG path for Maintain EBICS Order Type Determination

FI Bank Statements (MT940, MT942)

For the processing of bank statements, we need to have a variant in transaction FF.5. Also be sure to assign the relevant variant to the relevant message type in Customizing activity Maintain Selection Variants for Bank Statements.

BAI Lockbox

For the processing of lockbox files, we need to have a variant for report RFEKA700. Also be sure to assign the relevant variant to the relevant message type in Customizing activity Maintain Selection Variants for Bank Statements.

Import electronic bank statement file using SAP Multi-Bank Connectivity (MBC).

Bank >>>>>> MBC>>>> SAP S/4HANA System

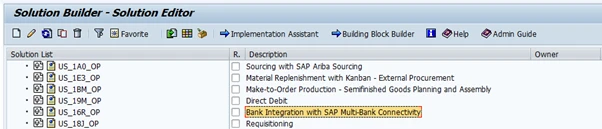

If the system is connected to SAP Multi-Bank Connectivity (MBC), the electronic bank statement file provided by the bank is stored in an SFTP folder, MBC retrieves the electronic bank statement file from SFTP, and then does the validation and mapping. This process integrates with the scope item Bank Integration with SAP Multi-Bank Connectivity (16R).

Figure: Best Practice Scope Item 16R

1. For banks with a Multi-Bank Connectivity (MBC) connection, bank statements are handled by MBC. MBC maps from the local bank statement format to an ISO CAMT.053 format, and SAP S/4HANA pulls the ISO CAMT.053 bank statement from MBC and then imports it automatically.

2. The SAP S/4HANA system schedules a background job every ten minutes to retrieve the bank statement file from MBC, and the file is automatically imported into the SAP S/4HANA system.

3. After the CAMT.053 bank statement is pulled from Multi-Bank Connectivity (MBC), the postings in bank accounting and subledger accounting are performed.

4. Since MBC maps the local bank statement formats to a CAMT.053 format, there is only one set of posting rules for the electronic bank statement.

Multi-Bank Connectivity Bank Statement import mechanism

At the point of time the electronic bank statement reaches the SAP S/4HANA system the note to payee information is analysed.

If the system is able to find a match, for example, based on the document number provided in the bank statement, it will perform the subledger accounting posting and thereby clear the open item of the business partner. If there is no match possible the reprocessing of items is needed.

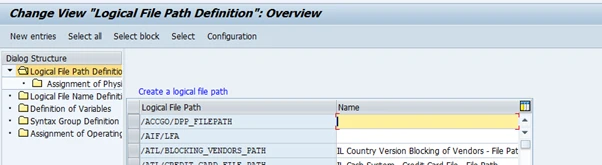

Logical File Path

Transaction Code: FILE

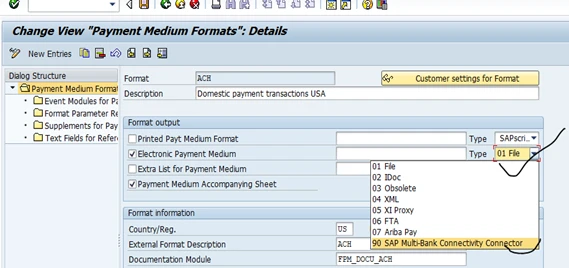

Payment Medium Workbench Configuration - SAP MBC

Transaction Code OBPM1.

OBPM1 settings are to be done for all the formats we use.

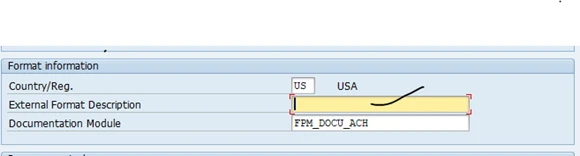

Select SAP Multibank Connectivity Connector Type field against behind Electronic Payment Medium

External format description is to be filled with correct format

Figure: OBPM1

Additional Information

For SAP Customers with an active license for SAP Multi-Bank Connectivity

If you have just obtained your license for SAP Multi-Bank Connectivity and you wish to start the Onboarding Process, please send an email to the SAP MBC Scoping mailbox (sap-mbc-scoping@sap.com).

If you haven’t been in contact with your MBC Onboarding Team for quite some time, and you wish to know who your Customer Success Manger and Technical Integration Engineer are, please send an email to the SAP MBC Onboarding mailbox (sapmbconboarding@sap.com).

If you don’t know who your company’s SAP Account Executive is, please review KBA 2626344. If you require technical assistance, please note the following components to use when creating a ticket in the SAP ONE Support Launchpad:

• LOD-FSN-SUP – Productive issues.

• LOD-FSN-AGT – Connector issues.

• LOD-FSN-INT – Non-productive issues.

• LOD-FSN-CER – Certificate renewal related queries.

• XX-SER-SAPSMP-SUP – S-User issues or issues when subscribing to get Cloud Alert Notifications via

• LOD-FSN-REQ – To initiate the onboarding process of additional banks via SAP Multi-Bank Connectivity.

For SAP Customers with NO license for SAP Multi-Bank Connectivity

If you are interested in implementing SAP Multi-Bank Connectivity, and you require more information about the capabilities of this solution, please contact your company’s SAP Account Executive.

If you don’t know who your company’s SAP Account Executive is, please review KBA 2626344.

If you have already reached out to your SAP Account Executive and they haven’t been able to provide you with the information you were looking for, please send an email to the SAP MBC Outbound Product Mangers mailbox (sap-mbc-outbound-enquires@sap.com).