Introducing Universal Parallel Accounting in SAP S/4HANA

Introducing Universal Parallel Accounting in SAP S/4HANA.

As of the release of SAP S/4HANA (on premise) 2022, Universal Parallel Accounting (UPA) is available for On-Premise and Rise with SAP Private Cloud customers. Universal Parallel Accounting is a new finance architecture for handling multiple accounting valuations & currencies in parallel. MNCs operating globally need to submit their financial statements according to multiple accounting principles. We already have the New GL feature to support multiple accounting principles by way of the ledger approach. But Universal Parallel Accounting takes this to the area of management accounting as well.

With Universal Parallel Accounting, you can benefit from the flexibility of the parallel ledgers not only in General Ledger Accounting but also in various subledgers. You can post different data for each ledger and therefore also display or select data from different ledgers in many finance apps. You can define up to ten currencies that can be used across all ledgers and accounting processes.

Universal Parallel Accounting is the basis for innovations such as

• Enhanced multicurrency capabilities

• Intelligent asset accounting

• Consistent support of single valuation ledgers

Please refer to the SAP documentation to understand the restrictions Universal Parallel Accounting has. Business function is to be activated on the system level (and not on client or organizational-unit level, for example, company-code level). That means the level of activation is the system level.

The following prerequisites must be met to activate Business functions:

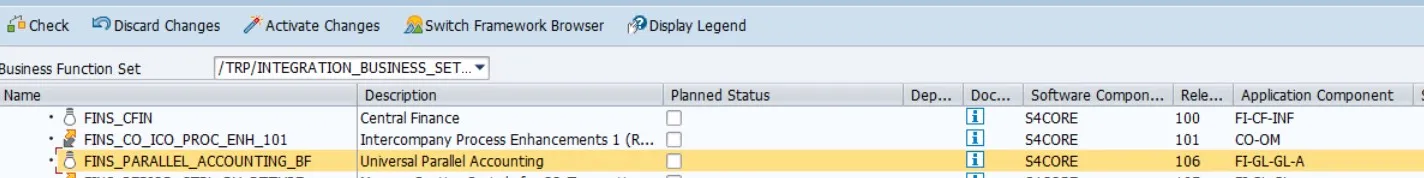

FINS_PARALLEL_ACCOUNTING_BF (Universal Parallel Accounting)

• No postings exist in any company-code in your system.

• Asset Accounting: No asset master data and no asset postings must exist in your system.

• Materials Management: No material master data and no material prices must exist in your system.

Figure showing Business functions: FINS_PARALLEL_ACCOUNTING_BF (Universal Parallel Accounting)

You can use this business function to calculate and post many financial processes per ledger. This leads to a high degree of automation and accuracy for parallel valuation runs. If you activate the business function, all ledgers and currencies configured for the Universal Journal will be relevant for the Material Ledger, Controlling, and Asset Accounting application components.

Please note: The activation of this business function has major implications for multiple business processes. Once the business function has been activated, it cannot be deactivated. For this reason, you must be aware of the consequences and plan and prepare for the activation well in advance.

For more information about the availability of the business function, its main functions (business function scope), and its main restrictions, see SAP Note 3191636.

What are the points to be considered before starting UPA project?

Before you start working with Universal Parallel Accounting, you should familiarize yourself with the following documents:

• Scope Information Note: 3191636

• SAP Note on FAQ : 3265275

• Business Function Documentation

What are the SAP Notes on Business catalogs and Tiles

• Business Catalogs and Tiles for Overhead Accounting with/without Universal Parallel Accounting: 3198793

• Business Catalogs and Tiles for Asset Accounting with/without Universal Parallel Accounting: 3191517

• Business Catalogs and Tiles for Inventory Accounting with/without Universal Parallel Accounting: 3205432

• Business Catalogs and Tiles for Sales Accounting with/without Universal Parallel Accounting: 320644

The current release includes support for the following country localizations: USA, Germany, France, Japan, and Romania. You can find more information in SAP Note 3191636 - Universal Parallel Accounting: Scope Information.

Universal Parallel Accounting allows customers to perform valuation runs and other closing tasks for their company using different accounting standards independently per ledger. This means that they can do your financial reporting for various processes on an end-to-end basis and thus benefit from full audit trails through consistent information across all ledgers, if they have activated the Universal Parallel Accounting (UPA) business function.

General Ledger Point of View

• For the implementation of Universal Parallel Accounting, you use separate ledgers and assign the required accounting principle to each ledger. You can either assign the same accounting principle to all company codes or you can assign accounting principles individually on company code-level.

• If you want to use group valuation in addition to the legal valuation, you also use a separate ledger. Group valuation is implemented using a single-valuation ledger approach, that is, separate types of valuation - the legal valuation and the group valuation - are stored in separate ledgers.

• As of the release SAP S/4HANA 2023, profit center valuation is available. It is also done in a separate ledger. Valuation is based on transfer prices that are used for trading between profit centers.

Asset Accounting point of view

• The Asset Accounting component provided with the Universal Parallel Accounting business function fully supports parallel accounting.

• It differs from the previous Asset Accounting in several ways. The data structures for asset master data and for configuration data were simplified and are now free of redundancies with General Ledger data structures.

• The posting logic has changed as well: All journal entries are now posted to the Universal Journal, even the statistical postings. All postings are ledger-specific. Reporting has changed accordingly.

Overheads point of view

• Parallel accounting is also supported by the Overhead Accounting application component.

• It differs from the previous overhead accounting solution in certain ways. Now you can run overhead calculations, actual cost rate calculations, and settlements per ledger. You can also maintain cost rates per ledger. The Cost of Goods Manufactured (COGM) solution is therefore not needed and not supported any longer with parallel accounting.

Material ledger Point of view:

• With parallel accounting, you can maintain material ledger data per ledger.

• You can now: Maintain material inventory prices per ledger with the app Manage Material Valuations (F2680) or in the material master apps (Create Material (MM01), Change Material (MM02), Display Material (MM03))

• Make mass changes to material prices per ledger with the app Upload Material Inventory Prices (F4006).

If your system has postings, what to do?

If data already exists in your system, you can check whether your system meets the prerequisites for a migration to Universal Parallel Accounting.

If postings exist in your system, the business function can only be activated in connection with a migration project and only if the prerequisites for the migration are met.

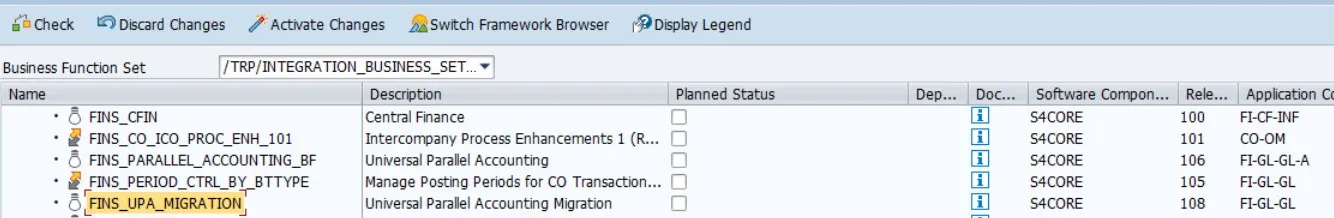

You use the business function FINS_UPA_MIGRATION if you want to use Universal Parallel Accounting in the future. But your system contains master data, transaction data, and Customizing data that you want to migrate to the new data structures so that you can then activate the Universal Parallel Accounting business function FINS_PARALLEL_ACCOUNTING_BF and

Business Function for this project is: FINS_UPA_MIGRATION

Business Function for the migration project is: FINS_UPA_MIGRATION

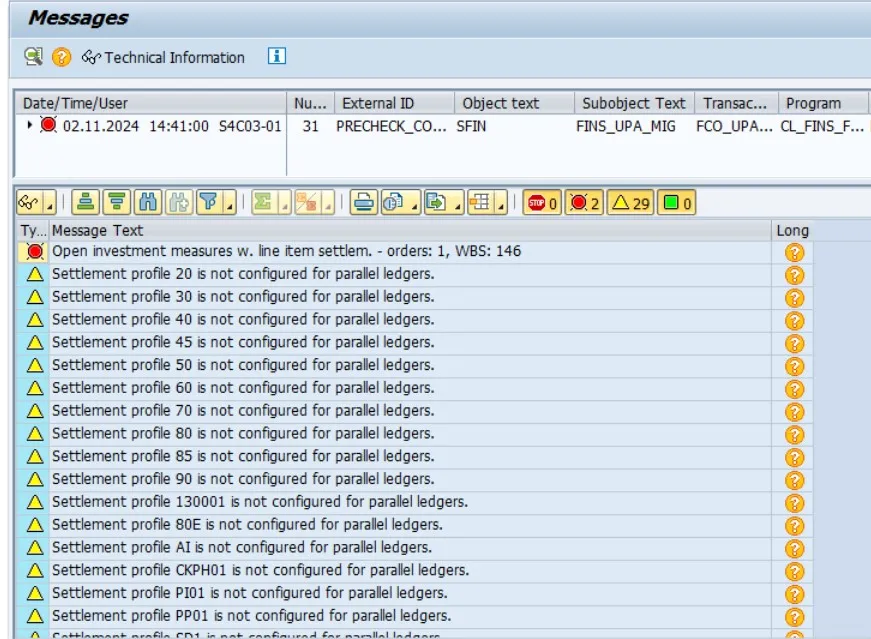

Before data migration, you need to perform prechecks to check whether your system is ready for data migration. You can only start with the actual data migration if there are no errors in the prechecks.

You perform the prechecks to determine whether your system is ready for the data migration to UPA. If these prechecks have been completed without errors, you can activate the business function Universal Parallel Accounting (FINS_PARALLEL_ACCOUNTING_BF).

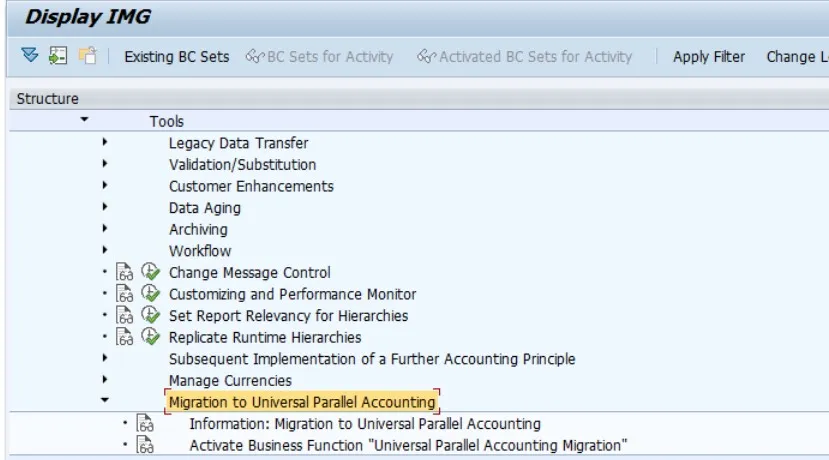

You can perform this activity under Implementation Guide (IMG) >> Financial Accounting >> Financial Accounting Global Settings>> Tools >> Migration to Universal Parallel Accounting:

Please note before you finally take decisions to Migrate:

• SAP recommends that you first test the migration to Universal Parallel Accounting in a sandbox system.

• To ensure that you get the best insights and understand the impact of the migration, this sandbox system should be a copy of the production system, ideally with the same hardware as the source system. This is to ensure that technical problems and performance issues can be detected at an early stage.

• Note the additional data volume that is created by the migration from the existing data model to the new data model.

What to do for migration?

• Creating a support case under component FI-GL-GL and enter “[Migration to Universal Parallel Accounting]” as the subject.

• Once SAP has approved the activation, implement the correction instruction in SAP Note 3325920.

• Activate the business function using the Switch Framework Customizing (transaction SFW5). Be aware that the activation cannot be reversed.

• Activate FINS_PARALLEL_ACCOUNTING_BF (Universal Parallel Accounting) business function. However, you do not need separate permission from SAP for this because this is included in the permission for the FINS_UPA_MIGRATION (Universal Parallel Accounting Migration) business function.

Follow-on Activities

• In the Implementation Guide under Prechecks, you run the precheck activities and the other relevant activities.

• Activate the change log for the migration project as described in SAP Note 2437986.

• After successfully completing the prechecks, you can continue with the pre-migration phase, which is also enabled using a business function (FINS_PARALLEL_ACCOUNTING).

The transaction data is migrated automatically using a migration cockpit. However, extensive preparatory steps are required, especially for the customizing settings in Asset Accounting, but you receive automatic support.

How to apply for the migration business function

Find out whether you are eligible to activate Universal Parallel Accounting.

You have successfully run the required prechecks. You can activate the business function. To do this, follow the steps in the given order:

1. Read the information provided in SAP Documents and SAP Notes including the business function documentation carefully.

2. Contact SAP and request authorization for the business function activation. To do this, create a case for component FI-GL-GL and enter "[Migration to Universal Parallel Accounting]" as the subject.

3. Once SAP has approved the activation, implement the correction instruction in SAP Note 3325920 (only accessible for authorized customers).

4. Also refer SAP note 3327778 - Migration to Universal Parallel Accounting (SAP S/4HANA 2023): Scope Information

Activate the business function using the Switch Framework Customizing (SFW5) transaction. Be aware that the activation cannot be reversed.

Note: You must also activate the FINS_PARALLEL_ACCOUNTING_BF (Universal Parallel Accounting) business function. However, you do not need separate permission from SAP for this because this is included in the permission for the FINS_UPA_MIGRATION (Universal Parallel Accounting Migration) business function.

Migration Prechecks for Overhead Cost Controlling

Find out which functions are supported and which prerequisites your system must fulfill regarding a migration to Universal Parallel Accounting. A migration to Universal Parallel Accounting (UPA) is only useful if the scope of Universal Parallel Accounting meets your business needs and only possible if your system fulfills the prerequisites for a migration. To find out whether your system can be migrated to UPA, you need to run a number of prechecks. The first prechecks that you should run focus on Overhead Cost Controlling. These prechecks include some very fundamental functions that help you decide very quickly whether migration is possible.

You can start the prechecks using transaction FCO_UPA_CHK_PREREQ.

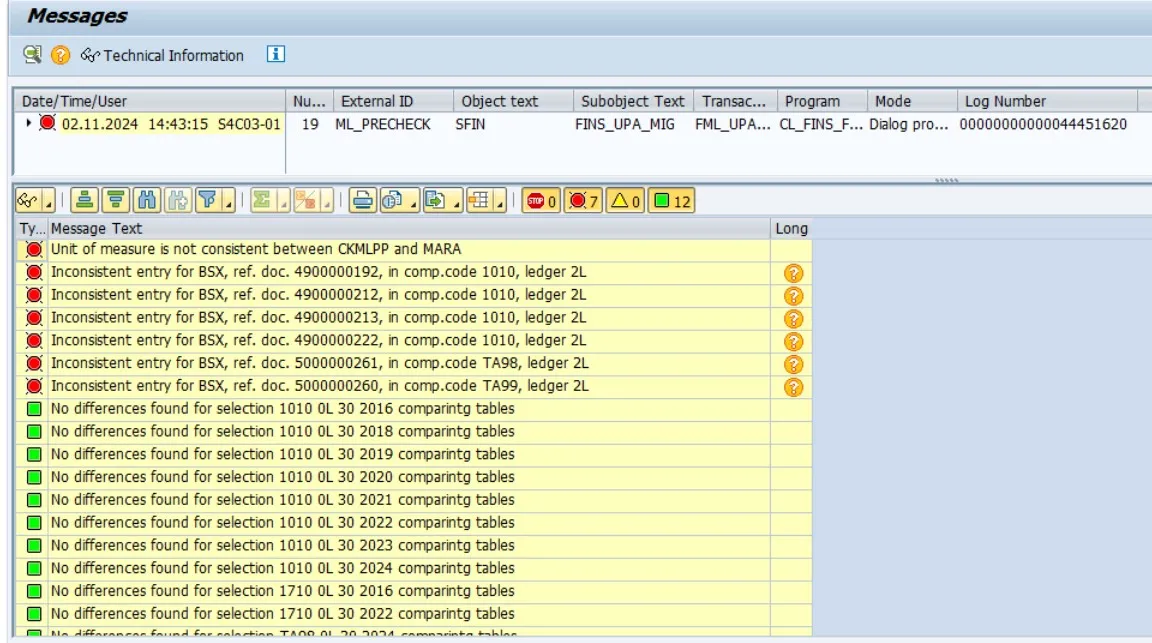

Migration Prechecks for Material Ledger and Actual Costing

You can start the prechecks for the material ledger using transaction FML_UPA_CHK_PREREQ.

The table outlines the following information:

• Whether a function is supported in Universal Parallel Accounting (UPA)

• Whether migration is possible when this function is used

• What additional migration-relevant information is available for this function

The table outlines the following information:

• Whether a function is supported in Universal Parallel Accounting (UPA)

• Whether migration is possible when this function is used

• What additional migration-relevant information is available for this function

Conclusions: Neither the business function for Universal Parallel Accounting Migration nor the migration programs are generally available. The business function Universal Parallel Accounting is still not generally available either. Instead, you have to request the activation of the business function.